Earnings | E&P | NGI All News Access

Liberty Oilfield Activity, Prices Rising, but ‘Serious Supply Chain Issues’ Impact 3Q

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |

M&A

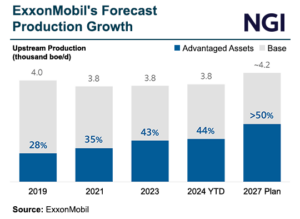

ExxonMobil on Friday clinched its $65 billion tie-up with Permian Basin heavyweight Pioneer Natural Resources Co., but the merger has not come without drama. The transaction, announced last October, moves ExxonMobil to the top of the heap in the Permian, with control of 1.4 million-plus net acres in the Delaware and Midland sub-basins. Estimated output…

May 6, 2024By submitting my information, I agree to the Privacy Policy, Terms of Service and to receive offers and promotions from NGI.