Banks that lend to the oil and gas sector have substantially reduced their expectations for natural gas prices over the next couple years, according to a new survey by Haynes and Boone LLP.

The law firm conducts a biannual Energy Bank Price Deck Survey of banks that offer reserve-based lending (RBL), a vital funding source for exploration and production (E&P) firms.

The price decks for natural gas and oil are a primary input for the banks in setting lending limits for E&P firms, a process known as borrowing base redetermination. The ritual occurs twice a year, in spring and fall.

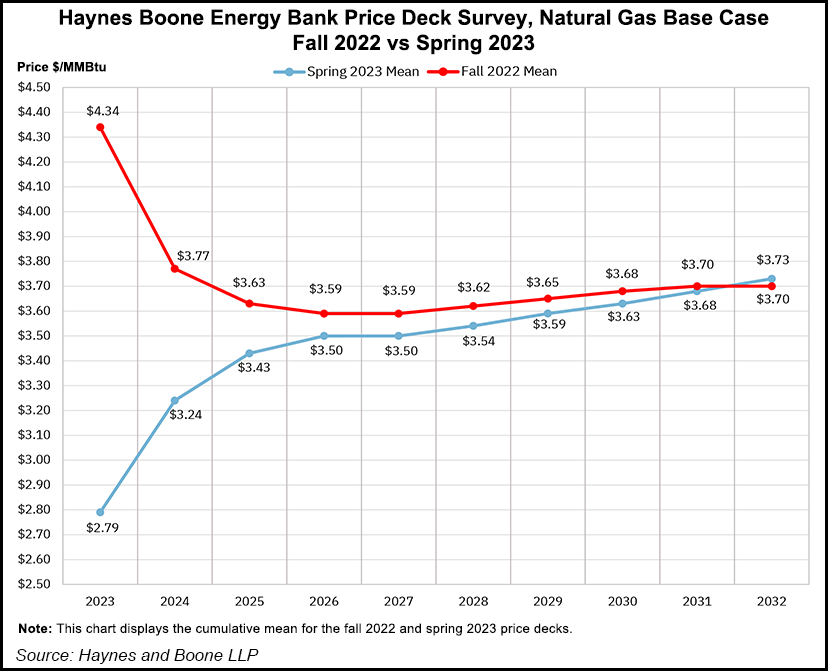

Respondents are now forecasting average base case Henry Hub natural gas prices of $2.79, $3.24 and $3.43/MMBtu for 2023, 2024 and 2025, respectively.

These prices compare to $4.34, $3.77 and...