Markets | Haynesville Shale | LNG | NGI All News Access

Laura’s Effects on LNG Demand Linger Through Weekend as Natural Gas Futures Fall

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |

Earnings

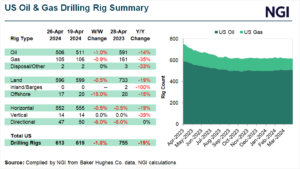

The slump in natural gas prices has pressured the U.S. land market, but signs are emerging that the rig count may be “nearing a leveling off point,” according to the CEO of Helmerich & Payne Inc. (H&P). Activity between January and March in the Lower 48 was fairly solid, CEO John Lindsay said during the…

May 2, 2024By submitting my information, I agree to the Privacy Policy, Terms of Service and to receive offers and promotions from NGI.