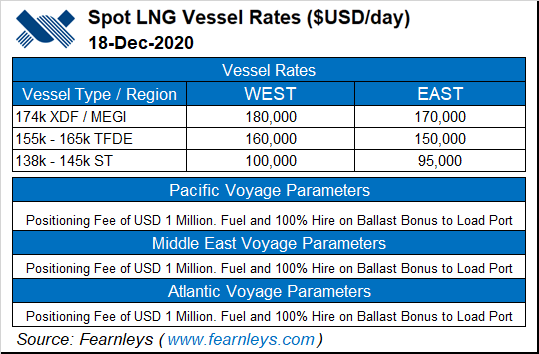

Increased U.S. liquefied natural gas (LNG) exports to Asia this winter have driven LNG vessel spot charter rates to two-year highs of $130,000/day, according to an analyst at shipbroker Poten & Partners.

“It is clear that the U.S. is the swing supplier for the LNG market,” said Poten’s Jefferson Clarke, head of LNG shipping analytics, during a recent webinar.

U.S. exports to Asia are having an “outsized” impact on shipping rates because of the longer routes compared to other producing regions. Many domestic cargoes have recently been routed around South Africa’s Cape of Good Hope because of constraints at the Panama Canal, Clarke said.

“Where cargoes are exported, and how fast the ship is traveling to get there, matters,” he said.

More Lower 48 LNG is