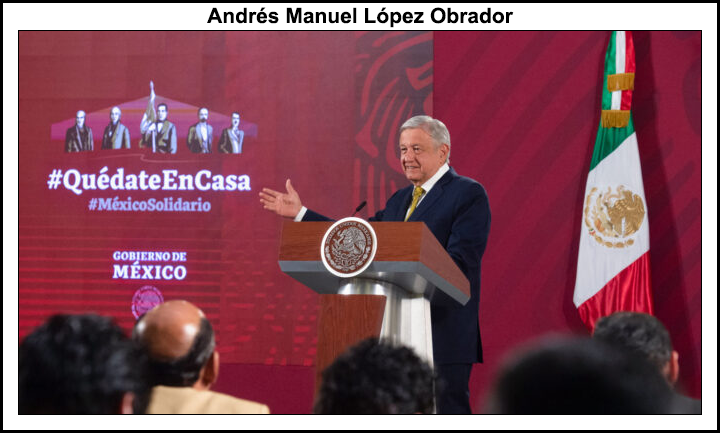

The June midterm elections in Mexico, set to be the country’s largest single-day election in its history, could either stall or advance President Andrés Manuel López Obrador’s state-centric energy sector platform.

The election would see the entire lower house being voted in, as well as numerous gubernatorial, state legislature and mayoral races.

Wins for his Morena party could give López Obrador authority to formally overturn the 2013-2014 energy reform, which he has railed against since coming to power at the end of 2018.

A counter reform would require a 66% majority in both houses of congress. López Obrador’s ruling Morena party has 60% of the seats in the senate; currently, the Morena coalition controls 65% of house seats.

The Baker Institute for Public...