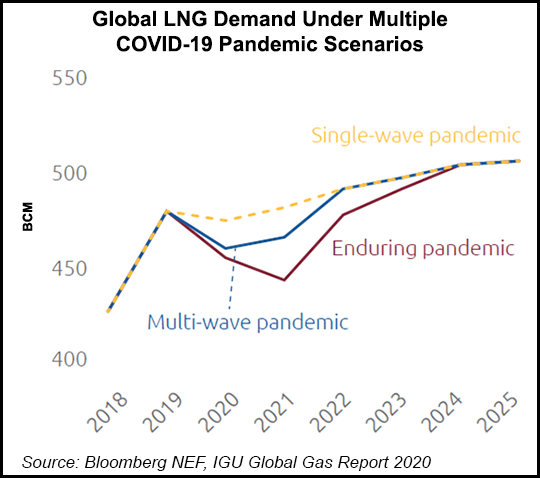

Global natural gas use is poised to decline this year as Covid-19 has cut into demand, but a quick recovery could be likely, driven by favorable economics, increasing access to the fuel and longer-term emissions reduction targets, according to the International Gas Union (IGU).

According to IGU’s latest Global Gas Report, developed with Bloomberg New Energy Finance and Italian infrastructure firm Snam SpA, worldwide gas use is set to fall by 4% this year after growing by more than 2% in 2019.

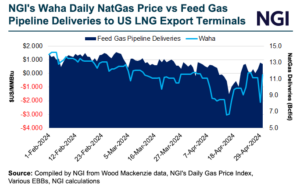

However, low gas prices, along with more clean air and climate policies, are likely to prompt further switching to gas from other more polluting sources like oil and coal.

“The pandemic has created disruption in the global energy sector, but low gas prices will ultimately stimulate...