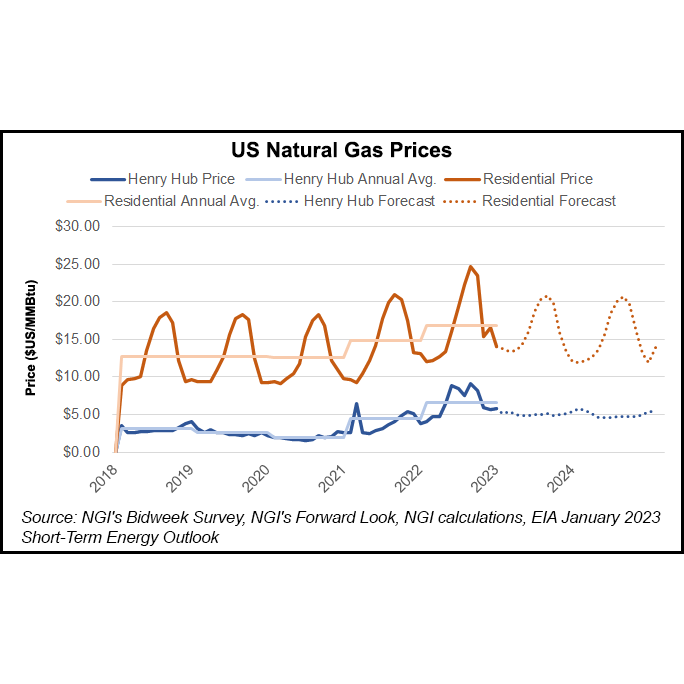

Natural gas prices have staggered into the new year, but Henry Hub is set to recover to average near $5/MMBtu for the first quarter of 2023, according to updated projections from the U.S. Energy Information Administration (EIA).

Despite dipping below $4 in early 2023, spot prices at Henry Hub will climb back above the $5 mark for late January into early February, the agency said in the January edition of its Short-Term Energy Outlook (STEO), published Tuesday.

The agency said it forecasts falling temperatures later this winter, and it also pointed to the scheduled partial restart of operations at the Freeport LNG terminal this month as a source of upward pressure on prices.

“Based on the most recent press release from Freeport LNG, we expect the facility to resume partial...