Asking natural gas and oil executives about the market, their projects, cash flow and budgets is a staple of the NGI Thought Leader team’s daily routine. Turning that microphone around to ask journalists the questions is a bit trickier! The Thought Leader team was up for the challenge, though, to editorialize as we enter 2023.…

Tag / 2023 forecast

Subscribe2023 forecast

Articles from 2023 forecast

What’s Ahead for Natural Gas Consumers in 2023?

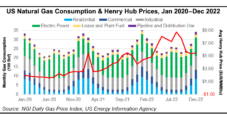

U.S. electricity consumption is forecast to decline this year and only marginally increase in 2024, but natural gas consumption gains may be seen amid rising industrial demand. Regulatory action also could be stymied, according to industry advocates. The American Gas Association (AGA) pointed out the positives on Thursday. Incoming Chair Suzanne Sitherwood, who is CEO…

North American E&P Spend Seen Moderating, but Still Up by Double-Digits in 2023

Only a few U.S.-based exploration and production (E&P) companies have provided formal capital spending plans for 2023, but expenditures overall are forecast to decelerate from a year ago. E&P executives are surveyed twice a year by Evercore ISI to determine the level of capital expenditures (capex) and activity, which often are revised. Respondents indicated that…

E&Ps Preaching Discipline Amid Softer Natural Gas Price Forecast, Prioritizing Energy Security Over ESG Transition

The U.S. natural gas and oil sector is likely to achieve moderate growth this year, preferring to hoard cash, reduce debt and continue investor payouts while awaiting stronger commodity prices, according to a bevy of energy analysts and executives. NGI pored through detailed forecasts by analysts and discussed the 2023 outlook with energy executives for…

CFE Alliances Driving Mexico Natural Gas Infrastructure Growth as Imports Cool Off

The past year marked a renewed sense of collaboration between Mexico’s state power utility Comisión Federal de Electricidad (CFE) and private sector energy firms, resulting in the sanctioning of new natural gas infrastructure projects and agreements to advance stalled ones. Meanwhile, Mexico’s pipeline natural gas imports from the United States were down year/year during summer,…

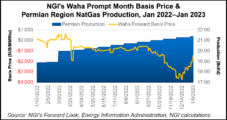

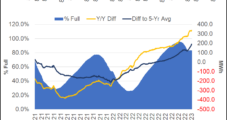

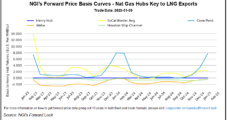

Emerging U.S. Pipeline Bottlenecks Cast Shadow on Otherwise Positive Long-Term Outlook for Natural Gas

As the United States works toward casting a wider net on the global natural gas market via exports, key domestic markets could be turned upside down in 2023 as midstream bottlenecks leave gas stranded in producing basins. LNG developers on the Gulf Coast are in a race to boost liquefied natural gas exports to capitalize…

Warm Winter in Europe Eases Natural Gas Restocking Concerns, but 2023 Still Looks Daunting

An unseasonably warm winter and ample LNG imports are dampening expectations for high volatility when European countries start restocking natural gas reserves this spring, but risk still abounds for a region facing a tight supply outlook for years to come. Headed into winter, the market faced the possibility of harsh weather and China’s return to…

Global Reshuffle Presents 2023 Opportunities for Risk-Takers in Mexico’s Natural Gas Sector

In 2023, Mexico’s natural gas industry will be shaped by public-private partnerships and the shifting landscape brought about by Russia’s invasion of Ukraine. Political risk for private and international firms, meanwhile, remains high. Last year, President Andrés Manuel López Obrador’s team said they would carry out costly infrastructure works in conjunction with the private sector.…

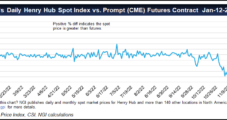

Henry Hub Seen Recovering Later This Month as EIA Models $5/MMBtu for 1Q2023

Natural gas prices have staggered into the new year, but Henry Hub is set to recover to average near $5/MMBtu for the first quarter of 2023, according to updated projections from the U.S. Energy Information Administration (EIA). Despite dipping below $4 in early 2023, spot prices at Henry Hub will climb back above the $5…

Volatility Laces 2023 Natural Gas Price Outlook Amid Robust Production, Demand Uncertainty

U.S. natural gas prices are off to a rocky start in 2023, and analysts are braced for a choppy ride ahead amid expectations for strong production levels, infrastructure constraints and forecasts for relatively mild weather during the heart of winter. Limits on American exporters’ collective ability to meet global needs add another layer of uncertainty…