Drilling expert Helmerich & Payne Inc. (H&P) said customer demand led to a 10% uptick in its North American rig count between April and June, as demand escalates for top-of-the-line super-specs.

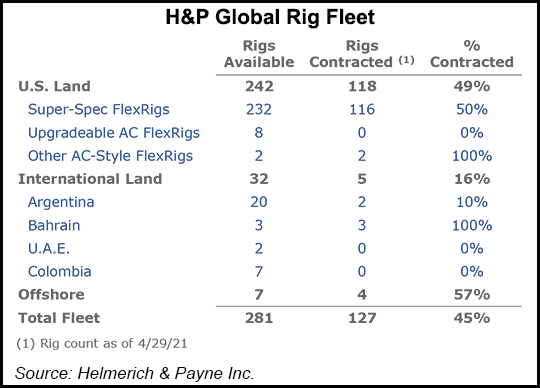

H&P designs, fabricates and operates rigs and technologies, led by its Flex-Rig alternating current super-specs. At the end of June, the global inventory included 252 U.S. land rigs, 21 international land rigs and seven offshore platform rigs.

In line with guidance, H&P exited June running 121 rigs in the Lower 48, or 10% more than in the year-ago period, CEO John Lindsay told investors during the fiscal 3Q2021 conference call. By late July, 123 FlexRigs were working in the U.S. onshore, he said.

Business is good, but costly, as H&P is pulling out rigs that for months have been...