Shale Daily | Coronavirus | E&P | Markets | NGI All News Access

Global Midstream Sector Outlook Downgraded by Moody’s

Moody’s Investors Service for the first time lowered its global oil and gas midstream rating to negative as the broader energy sector grapples with simultaneous demand and supply shocks.

In its outlook released last week, the Moody’s research team said that interstate natural gas pipelines are less vulnerable than others when it comes to price or volume risk. Moody’s in April maintained its forecast for the natural gas sector, saying that because prices started to decline in mid-2019, demand and supply responses are well underway.

Overall, though, the midstream sector is projected to see at least a 5% decline in earnings before interest, taxes, depreciation and amortization (EBITDA) this year. That compares with a minus 5% to 5% EBITDA growth that would maintain a stable outlook for the sector, according to Moody’s.

“Midstream cash flow is largely insulated from the full brunt of commodity price and volumetric instability, but the rapid pace and the magnitude of production declines have finally spilled into the midstream sector, compromising its aggregate credit quality,” said the Moody’s research team, which is led by VP-Senior Credit Officer Andrew Brooks.

Moody’s expects a slight return to growth in 2021 but cautioned that although the midstream asset base is largely “must-run” infrastructure, not all of its revenue and earnings are fully insulated from commodity price and volume risk. It pointed to pipeline revenue for crude and refined products, which is susceptible to variable throughput volumes, which have recently declined. Natural gas gathering and processing entails both direct and indirect commodity price risk based on gathering field economics, as well as volumetric risk, based on the structures of processing contracts, researchers said.

The Energy Information Administration expects a 12.2% two-year decline in U.S. crude output from 2019-21, and a 7.4% decline in natural gas production. Contract structures and pricing may ease the full impact of these volume declines on midstream companies’ performance, according to Moody’s, but not enough to avoid an aggregate 5%-plus decline in EBITDA.

“The credit quality of individual midstream companies will largely depend on the size and composition of their own assets,” Moody’s said.

Furthermore, midstream firms also face risk from the deteriorating credit quality of their exploration and production (E&P) customers, some of which now face heightened bankruptcy risk. Indeed, the management teams at Kinder Morgan Inc. and Targa Resources Corp. told investors during first quarter earnings calls that they continued to monitor their customers’ credit profiles but at the time saw no “material” risk.

Though midstream contract rejections were not widespread during the 2015-2016 energy downturn, with most contracts affirmed in bankruptcy, Moody’s said most E&P companies today will ratchet up demands for contractual concessions from the midstream operators, particularly if the economic contraction deepens.

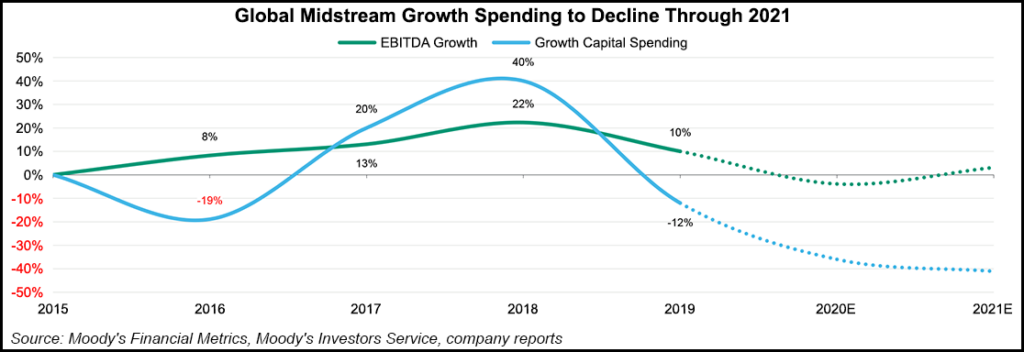

Given the broader contraction in the energy industry, spending by the midstream sector is expected to decrease through 2021, which would lead to further declines in future EBITDA, according to Moody’s. Researchers said that although growth in midstream capital has responded “robustly” to the infrastructure needs of the industry throughout the shale expansion, companies are now cutting their growth capital spending as E&P requirements for new infrastructure ebbs. Midstreamers also are rationing capital investment to help generate positive free cash flow, the team said.

Moody’s pointed out that midstream growth capital spending began to decline in 2019, falling 19% among a group of large midstream companies, but that level of decline is accelerating to a 20-30% annual drop in 2020-21. “Once capital spending winds down for projects now under construction, EBITDA growth will have less support in the future as midstream rapidly evolves into more of a slow-growth sector.”

Raymond James & Associates evaluated the idea of a “new normal” for midstream valuations, finding that no matter the various macro dynamics at play, “volatility will continue.” The firm said that one could argue that midstream valuations fell too far this spring, and haven’t bounced as much as some might have expected. Overall, however, valuations still look pretty attractive, even in the context of valuations in prior oil decline environments, according to the firm’s team of analysts.

Furthermore, valuations should continue to improve, simply to reprice the stocks to historical levels seen the last time the U.S. production outlook was similarly negative. Improvement also is expected to improve since spreads between high quality and riskier stocks are roughly at “normal” levels currently, Raymond James noted.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |