NGI The Weekly Gas Market Report | Coronavirus | E&P | Earnings | Infrastructure | Markets | NGI All News Access

Kinder Morgan Sees Natural Gas as Bright Spot, Remains Confident in Transport Contracts

Like other energy companies up and down the supply chain, Kinder Morgan Inc. (KMI) took one on the chin during the first quarter, but management for the midstream giant said natural gas stands to fare better than other segments in weathering the historic oil price downturn and coronavirus pandemic.

CEO Steven Kean and his management team on Wednesday offered the first insights into what the U.S. midstream sector is facing as exploration and production companies reduce activity and Covid-19 clobbers demand.

[Want to see more earnings? See the full list of NGI’s 1Q2020 earnings season coverage.]

“I’ll begin on a grateful note,” Kean said during an earnings call. The company chief touted multiyear efforts to strengthen the balance sheet, actions he said have positioned the company for these “challenging times.” He also expressed gratitude that the sale of the Canadian business was completed and proceeds converted to cash “at an attractive time,” as it hedged crude early in the year.

“I’m glad that we have a disciplined approach to capital investment and that we operate with a business model that insulates us from some of the worst of the current double impact on energy markets right now,” Kean said.

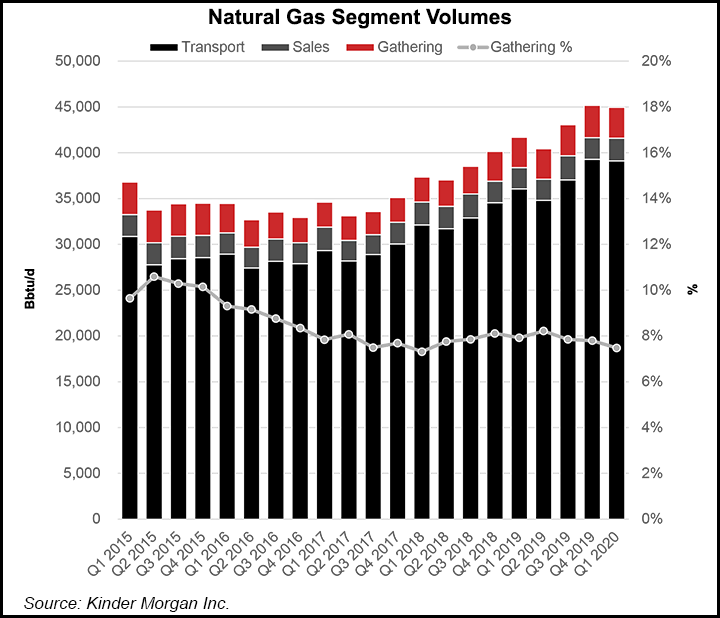

Refined product volumes are “coming down in a way we’ve never seen before,” but natural gas transportation and storage remain “relatively strong,” with transport volumes during the quarter coming in 8% higher, or 3 Bcf/d, year/year. Natural gas gathering volumes were up 2% from a year ago, while natural gas liquids transport volumes were down 6%.

Crude and condensate pipeline volumes increased 9% year/year, and despite the decline in volumes in March, total refined product volumes were flat compared with 1Q2019. KMI is currently seeing about a 40% to 45% reduction in refined products volumes, which will impact both the Product Pipeline and Terminals segments.

“Sharp declines in both commodity prices and refined product demand in the wake of the Covid-19 pandemic clearly affected our business and will continue to do so in the near term,” President Kim Dang said.

However, the lower refined products volumes are only temporary, according to Kean. “There are all kinds of views about how long is ”temporary’ and when we will get to the other side, but we will get there.”

The majority of volumes flowing on KMI’s transportation pipes are under take-or-pay contracts, which insulate the company from lower volumes in the future. Furthermore, as the Railroad Commission of Texas considers whether to mandate prorationing oil output by 20% across the state, management evaluated the force majeure provisions in its contracts and found there are no excused obligations to pay.

However, CFO David Michels cautioned that while there is not a “material risk at this point,” KMI may be exposed to potential credit default events. On that front, management continues to evaluate its customer base, considering such factors as whether there has been a credit downgrade and what the outstanding receivables are, Kean said. The company also seeks and calls on collateral “where we have the rights to do so.”

KMI also looks at the underlying value of the capacity a particular customer is holding and to what extent, in a “worst-case scenario,” they still need the capacity in order to be able to get their product to market.

“There is no good analogy to the current year,” Kean said. “But if we look at something that was similar in terms of impact on the producer segment, we go back to 2016. Our bankruptcy defaults in 2016 amounted to about $10 million.”

While 2020 is shaping up to be worse, there are mitigations in place, according to Kean. “It’s also a little bit difficult to call your shots on who you think is going to tip over or not tip over.”

KMI’s Tom Martin, president of Natural Gas Pipelines, said the oil market downturn is in the “very early days” but shut-ins already are occurring. Moving into May, he expects associated gas plays to be hardest hit.

“Some Permian Basin volumes will be declining or coming off,” he said. The Bakken Shale “will be impacted as well. Those are probably the two biggest areas that we’re seeing.”

On the flip side, as the year progresses, KMI may see some incremental activity in the dry gas plays, particularly in the Haynesville Shale. “We’re already getting some inbound inquiries…So I think we’ll see some potential offset in those areas, maybe late this year or early next year,” Martin said.

Kean agreed that KMI has the ability to pivot to dry gas services, “with plenty of room to grow to the extent the gas market comes back into balance, with the reliance less on associated gas volumes and more on dry gas volumes.”

KMI has reduced expenses and sustaining capital expenditures by more than $100 million, and has slashed the expansion capital outlook for 2020 by around $700 million, or almost 30%. The remaining spend targets “good project investments,” according to management.

“Our financial principles remain the same,” Kean said. The company intends to maintain a strong balance sheet and capital discipline “through our return criteria, a good track record of execution and by self-funding our investments.”

Executive Chairman Richard Kinder echoed that sentiment. KMI has the financial wherewithal to meet its $1.25/share annual target in 2020. However, “the wise choice” is to preserve flexibility and balance sheet capacity. Instead, KMI has opted to increase the dividend by 5% a year to $1.05/share. “Doing so, we believe we have struck the proper balance between maintaining balance sheet strength and returning value to our shareholders, which remains a primary objective of our company,” he said.

KMI “remains committed” to increasing the dividend to $1.25 assuming a return to normal economic activity, and management hopes to make that determination when the board meets in January to determine the dividend for the fourth quarter of 2020.

For the year, KMI expects adjusted earnings to come in 8% below contemplated guidance of $7.6 billion, but there is still “considerable uncertainty” regarding the pace and extent of a global economic recovery, management said. Distributable cash flow (DCF) is expected to be 10% below the $5.1 billion in the budget.

Breaking down the revised outlook, the natural gas segment is projected to be down 4%, or $457 million, while products is expected to be down about 17%, or $86 million. The terminals business is estimated to be down 5%, or $31 million, and CO2 is projected to be down 16%, or $128 million.

KMI had more than $3.9 million of borrowing capacity at the end of the quarter. Cash from operations, cash on hand and excess borrowing capacity “are more than adequate to allow us to manage our day-to-day cash requirements, as well as the debt maturing over the next 12 months,” Kean said.

KMI reported a first quarter net loss of $306 million (minus 14 cents/share), compared with net income of $556 million (24 cents) in 1Q2019. DCF was $1.26 billion, an 8% decrease year/year.

Want to see more earnings? See the full list of NGI’s 1Q2020 earnings season coverage.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |