The cold snap earlier this winter in Asia and Europe that sent prices skyrocketing and buyers scrambling for liquefied natural gas (LNG) cargoes was an indication that the global market is becoming too reliant on spot deliveries, said Freeport LNG CEO Michael Smith.

“There’s been an overreliance on spot cargoes in our industry,” he said Wednesday at CERAWeek by IHS Markit. “Spot cargoes are here to stay. They’re great; they help diversity of supply, but if you’re a utility, security of supply is the most important thing. You just need some long-term contracts. In a balanced portfolio, you can’t just live on spot.”

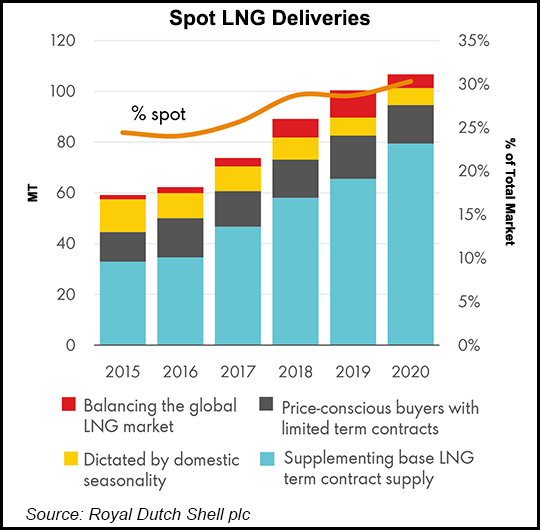

Indeed, spot cargoes accounted for more than 30% of all deals last year, up from about 15% in 2015, according to one of the world’s largest LNG...