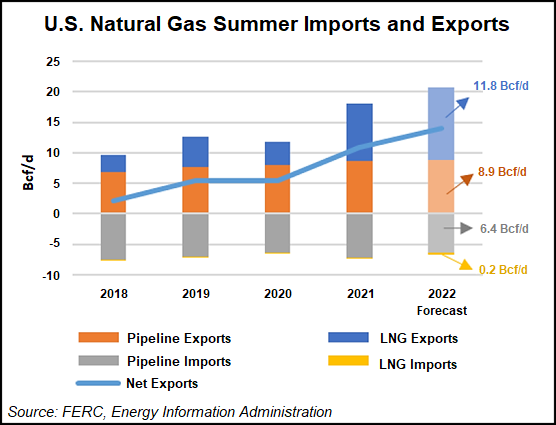

Driven in part by liquefied natural gas (LNG) exports, demand growth will outpace supply gains this summer, leading to higher prices year/year, FERC said in its 2022 outlook on summer energy markets.

Compared with summer 2021 levels, total domestic dry natural gas production is expected to increase 3.4% this summer, while total consumption is projected to rise 4.8%, according to a summer assessment prepared by Federal Energy Regulatory Commission staff.

The higher natural gas prices, alongside projected hotter temperatures and a slight increase in electricity demand, point to higher wholesale electricity prices this summer, according to the agency. FERC pointed to futures at electricity trading hubs showing gains from 77% to 233% versus year-earlier periods.

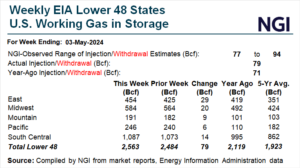

FERC cited Energy...