ExxonMobil, which gave oomph to the North American natural gas revolution a decade ago, warned Friday its assets are facing a writedown of $25-30 billion and could be for sale.

An internal assessment is underway to determine the fate of the dry gas assets, principal financial officer Andrew Swiger said during the quarterly conference call. Swiger was joined by investor relations chief Stephen Littleton and Senior Vice President Jack Williams, who oversees the downstream and chemicals businesses.

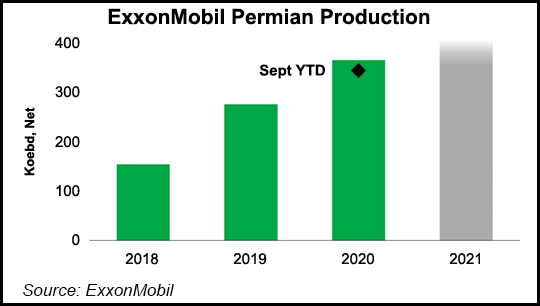

Short-cycle projects in the Permian Basin are a go, but ExxonMobil is working with its partners to defer some downstream, chemical and unspecified liquefied natural gas (LNG) projects, Williams said. “Importantly, we’re not canceling any projects that are in execution in the funding...