Anybody hear about hydrogen’s potential in the energy transition? A better question: has anyone not heard about the potential for the ancient element to upend the oil and gas complex?

Hydrogen in all its myriad colors has become omnipresent in every conversation about the energy transition. Oil and gas operators of all shapes and sizes are working toward a lower carbon emissions future, but talk, as they say, is cheap.

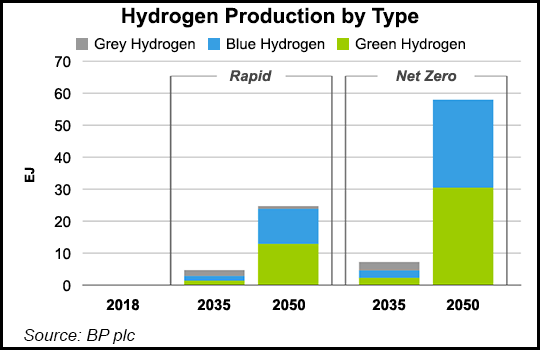

“Hydrogen has gone from relative obscurity to near ubiquity in the past 12 months,” Tudor, Pickering, Holt & Co. (TPH) analysts said. While “the potential is huge, the hurdles are significant, and meaningful scale is likely multiple decades away.”

Hydrogen holds great promise, though, and that’s why it’s all the buzz. It could expand options for...