NGI Archives | NGI All News Access

Eagle Ford Shale Is a Dollars and Jobs Gusher

By 2021, the Eagle Ford Shale could produce nearly $62.1 billion in output, support about 82,600 full-time jobs, add nearly $34 billion in gross regional product and about $888 million to local government revenues and $1.6 billion to state revenues, according to a new studies of 14 South Texas counties comprising the Eagle Ford area.

A study of counties with active drilling prepared by the Center for Community and Business Research at The University of Texas at San Antonio found that in 2011 companies operating in the region had significant impacts in the 14-county area and in surrounding counties.

These impacts translated into more than $19.2 billion in output, 38,000 full-time jobs supported, close to $10.5 billion in gross regional product, $211 million in local government revenues, and $312 million in state revenues.

From the fourth quarter of 2009 to the fourth quarter of 2011 employment in the 14 counties increased by 14,237 jobs, a 9.2% increase. This growth is more than double the employment growth in the state of Texas of 4.3% for the same period, the study said. For the 14 counties, the highest growth rate corresponds to the natural resources and mining sector (51.5% increase); followed by the professional and business services sector (23.9% increase), and the public administration sector (16.2% increase).

“Another indicator of the benefits from the Eagle Ford Shale is the amount of sales taxes that these counties receive,” the study said. The area’s sales subject to sales tax in the fourth quarter of 2009 were $861 million with an increase to more than $1.23 billion by the end of the fourth quarter of 2011, an increase of 42.9%. This is nearly double the 21.7% change in sales tax collection by the state during the same period.

The 14 producing counties examined in the report are Atascosa, Bee, DeWitt, Dimmit, Frio, Gonzales, Karnes, La Salle, Live Oak, Maverick, McMullen, Webb, Wilson and Zavala.

Between 2010 and 2011, construction and extraction occupations showed the largest increase in the 14-county region, according to a separate workforce analysis of the Eagle Ford that was prepared by the same organization. The direct and indirect impacts came from occupations dealing with exploration, drilling, production and midstream development. Eagle Ford activity provided an occupational impact of 11.4% in the 14-county region. The occupations that saw the largest increase in relevance were construction and extraction, production occupations, architecture and engineering occupations, transportation and installation, maintenance and repair occupations, according to the research. Legal, management, physical and social science, office support and computer and mathematical sciences were also significantly impacted relative to their 2010 levels.

From 2010 to 2021, construction and extraction occupations will continue to be the most relevant in the 14-county region, the study said. However, the drilling and production phases are expected to be much more evenly distributed. Architecture and engineering, physical and social science and production occupations also showed large increases relative to their 2010 levels, the study said.

“Overall, between 2010 and 2021, Eagle Ford development is estimated to impact occupations within the 14-county region by 23.5%. These estimates can serve as a key policy tool for long-term growth planning in the projected occupations,” the study said.

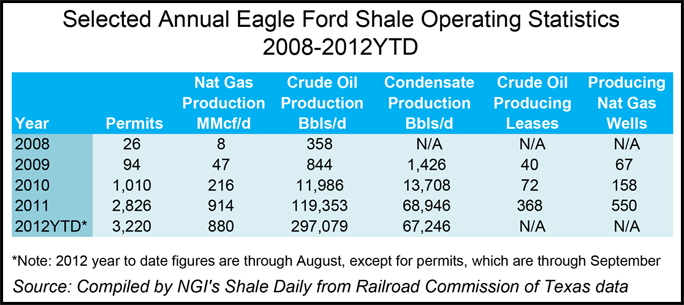

Exploration and production activity in the Eagle Ford Shale has exploded over the last five years, according to Railroad Commission of Texas data and NGI‘s Shale Daily calculations. The number of oil and gas drilling permits have increased from 26 in 2008 to 3,220 in 2012 year-to-date. Over that period of time, natural gas production from the play has increased from 8 MMcf/d to 880 MMcf/d, while crude production jumped from 358 b/d to 297,079 b/d.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |