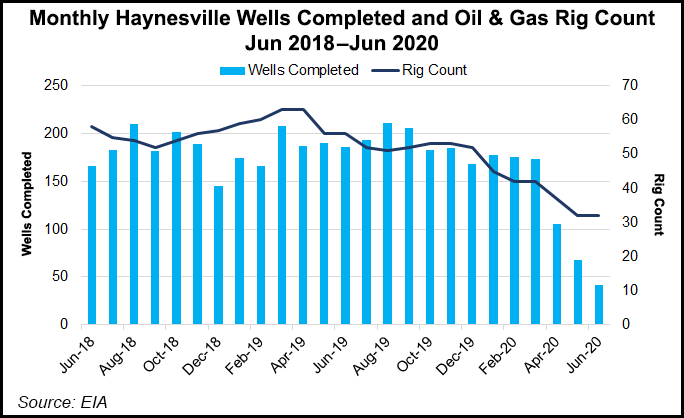

Haynesville Shale giant Comstock Resources Inc. is changing its tune. After adopting a moratorium on bringing new wells online in the natural gas-rich play from April through June, some completion activity has now resumed in anticipation of a bump in prices this winter.

CEO Jay Allison, during a conference call to discuss 2Q2020 results, said gas prices have remained “relatively low,” but the outlook “has improved substantially for late 2020 and 2021.”

During 2Q2020, 18.9 net wells in the Haynesville and Bossier plays were drilled but uncompleted, aka DUCs. Comstock now expects to turn online 25 DUCs through the end of the year.

The Frisco, TX-based independent, majority controlled by Dallas Cowboys owner Jerry Jones and family, has intentionally reduced the...