Though widespread summer heat keeps getting kicked down the road, natural gas forward prices strengthened for the trading period ending May 12 as export demand led markets higher.

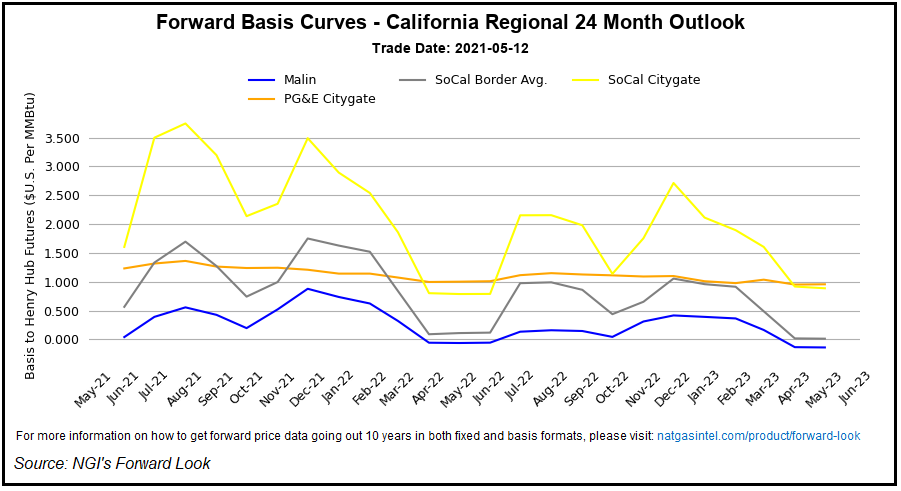

June forwards rose an average 4.0 cents, with similar gains seen through next winter (November 2021-March 2022), according to NGI’s Forward Look.

Larger increases were seen in the West, where early season heat combined with projections for an even hotter summer and below-average hydro output to fuel double-digit gains at the front of the curve.

In Southern California, SoCal Citygate June forward prices jumped 11.0 cents from May 6-12 to reach $4.574/MMBtu, Forward Look data showed. This compares to spot prices last June that averaged around $1.970.

The forward curve points to even higher prices...