BJ Services to Unload Cementing Business, Some Fracturing Assets as Covid-19 Claims Another Energy Operator

North American completions specialist BJ Services LLC filed for voluntary bankruptcy protection on Monday, indicating it is working with potential buyers for some of its assets as it restructures.

The voluntary filing, one of now more than two dozen since the beginning of the year as Covid-19 sent energy demand spiraling, was made Monday in Houston in U.S. Bankruptcy Court for the Southern District of Texas.

BJ’s Canadian affiliate also is seeking protection under the nation’s Companies’ Creditors Arrangement Act to wind down those operations.

In connection with the Chapter 11 restructuring, BJ “intends to sell its assets and is in active discussions with bidders regarding both the cementing business and portions of the fracturing business.” Successfully selling some assets could reduce the number of jobs impacted by the process, management said.

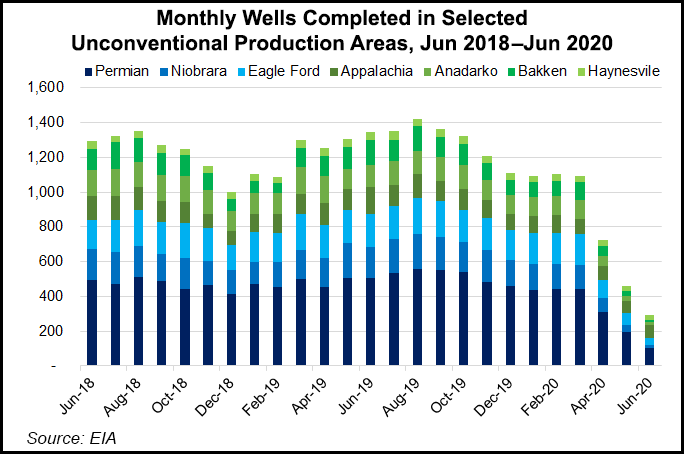

“The industry continues to face unprecedented uncertainty caused by volatile commodity markets and significantly reduced demand due to the Covid-19 pandemic,” CEO Warren Zemlack said.

“Despite maintaining a leading market position and strong client support, the severe downturn in activity and subsequent lack of liquidity resulted in an unmanageable capital structure. After exhausting every possible alternative to address these issues and improve our liquidity, we have made the very difficult decision to proceed with a Chapter 11 process.”

The board and management team, he said, had worked for weeks “to avoid this outcome.” Still, having interested bidders for the cementing business and portions of the fracturing business and technology is gratifying, he said.

A plan is under development with stakeholders to minimize disruptions to “current client activity as much as feasible,” and management is “reaching out to clients to discuss available options.” In addition, management is working with lenders to procure liquidity to fund its sales and wind down through the Chapter 11 process.

“I want to assure our business partners that our team is as focused as ever on working with our stakeholders to procure sufficient liquidity to complete all client activities safely and in accordance with all applicable laws and regulations,” Zemlak said.

BJ filed several customary first day motions with the court to support the Chapter 11 process, including a motion to continue providing wages, salaries and benefits to employees who continue working during this period.

In addition to its operations in the United States, BJ has a presence or operates in most major basins throughout Canada.

Kirkland & Ellis LLP is serving as legal counsel, while PJT Partners has acted as investment banker and financial adviser. Ankura Consulting Group LLC is acting as restructuring adviser, and Simmons Co. is acting as adviser in selling the cementing business.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |