Jeremiah Shelor joined NGI in 2015 after covering business and politics for The Exponent Telegram in Clarksburg, WV. He holds a Master of Fine Arts in Literary Nonfiction from West Virginia University and a Bachelor of Arts in English from Virginia Tech.

Archive / Author

SubscribeJeremiah Shelor

Articles from Jeremiah Shelor

Models Failing to Impress With June Heat as Natural Gas Futures Down Early

With weather models over the weekend failing to add heat through the first third of June, and with supply expected to continue driving larger-than-normal builds, natural gas futures were trading several cents lower early Tuesday.

Pipeline Maintenance Sinks Permian Prices; Natural Gas Futures Steady

The natural gas futures market turned in a quiet day of trading Friday as the latest readings on fundamentals didn’t offer much to excite traders and peel them away from their holiday plans. In the spot market, pipeline maintenance drove record lows in the Midcontinent and sent stopped-up West Texas deep into the red; theNGISpot GasNational Avg.dropped 27.0 cents to $1.805/MMBtu.

Production Helps Provoke Natural Gas Futures Sell-Off

Rebounding production and a lack of significant cooling demand gains from the latest forecasts facilitated selling in the natural gas futures market Tuesday. In the spot market, pipeline maintenance continued to pressure Midcontinent and West Texas prices; theNGISpot GasNational Avg. climbed 14.0 cents to $1.945/MMBtu.

Weather Outlook Mostly Unchanged; Natural Gas Futures Down Early

With no major changes to the weather outlook overnight, and with the market continuing to mull the latest government storage data, natural gas futures were trading slightly lower early Friday. The June Nymex futures contract was down 1.0 cent to $2.568/MMBtu shortly after 8:30 a.m. ET.

Smaller-Than-Expected Injection Boosts Natural Gas Futures

A weekly inventory build on the low side of estimates and a warmer-leaning early June outlook supported a small bounce in U.S. natural gas futures prices Thursday. In the spot market, heat in the Southeast and cooler temperatures in the West did little to impress buyers; the NGI Spot Gas National Avg. eased 0.5 cents to $2.075/MMBtu.

Record Lows for Midcon Cash as Natural Gas Futures Steady

The natural gas futures market turned in a quiet day of trading Friday as the latest readings on fundamentals didn’t offer much to excite traders and peel them away from their holiday plans. In the spot market, pipeline maintenance drove record lows in the Midcontinent and sent stopped-up West Texas deep into the red; the NGI Spot Gas National Avg. dropped 27.0 cents to $1.805/MMBtu.

Southeast Heat Can’t Erase Weakness in Weekly Natural Gas Spot Prices

The prospect of record Southeast heat provided the lone bright spot for natural gas bulls in the spot market during the week ended May 24; with widespread discounts in the lead-up to Memorial Day, the NGI Weekly Spot Gas National Avg. tumbled 17.5 cents to $2.035/MMBtu.

Another Three-Digit EIA Injection; NatGas Balances in Need of ‘Material Improvement’

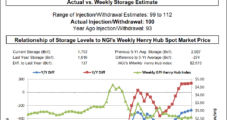

The Energy Information Administration (EIA) on Thursday reported a 100 Bcf weekly injection into U.S. natural gas stocks, a figure on the low side of estimates that elicited a fairly muted reaction from the futures market.

June Natural Gas Sees Early Gains as Hefty EIA Build Inbound

With traders bracing for the latest government storage data, another injection expected to land in the triple digits, natural gas futures were inching higher early Thursday. Coming off a 13.0-cent nosedive over the two previous sessions, the June Nymex contract was up 2.8 cents to $2.571/MMBtu shortly after 8:30 a.m. ET.

Natural Gas Futures Extend Slump on Large Storage Build

Coming off a 6.0-cent sell-off on Tuesday, the June Nymex futures contract plunged another 7.0 cents on Wednesday to settle at $2.543. Losses were steeper further along the summer strip. July shed 8.2 cents to $2.559, while August dropped 8.2 cents to $2.574.