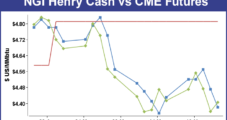

It was a stretch of solid, yeoman-like advances in gas prices for the three-day week ended May 29. TheNGIWeekly National Spot Gas Average recorded a gain of 9 cents to $4.30. Only two points fell onto the loss side of the trading ledger and all regions posted gains ranging from a few pennies to well over a dime. Greatest gains were seen on Tennessee Zone 6 200 L with a rise of 44 cents to average $4.13, while the largest loss was just 3 cents on Florida Gas Zone 2 to $4.43.

Archive / Author

SubscribeBill Burson

Articles from Bill Burson

Third Triple-Digit Storage Build Anticipated, Yet July Called Flat

July natural gas is expected to open unchanged Thursday morning at $4.62 as traders anticipate a storage build report well above seasonal norms. Overnight oil markets rose.

Bears Barely Moving Following Stout EIA Storage Report

Natural gas futures dropped Thursday morning following the release of government storage figures that were somewhat on the high side of what traders were expecting.

Broader Strength Trumps Northeast, Marcellus Weakness; Futures Slide Post EIA Report

Spot natural gas for Friday delivery overall moved little, and large setbacks at Northeast and Marcellus points were more than offset by broad gains in the Gulf Coast, Rockies and California. East Texas was also strong.

Traders Balancing Stout Physical Market With Expected Triple-Digit Build

The expiring June futures contract is seen opening 2 cents higher Wednesday morning at $4.53 as traders mull strength in the cash market and position themselves before the release of Thursday’s gas storage report. Overnight oil markets eased.

Strong June Expiration Leads Physical Market Higher; Futures Add 11 Cents

Physical natural gas for Thursday delivery rose again in screen-directed trading on Wednesday. Nearly all points saw gains from a nickel or more in the Gulf to double-digit advances in the Great Lakes, Marcellus, Mid-Atlantic and Appalachia. There was little weather inspiration, and much of the gains mirrored the gains posted by the expired June futures contract. At the close June had settled at $4.619, up 11.4 cents, while July finished 10.4 cents higher at $4.615. July crude oil tumbled $1.39 to $102.72/bbl.

Power Load Seen Lean; June Called 3 Cents Lower

June natural gas is set to open 3 cents lower Tuesday morning at $4.38 as the longer-term weather-storage dynamic is seen giving the bears the upper hand. Overnight oil markets slumped.

East, Northeast Lead Upward Charge; Futures Vault Higher

Physical gas for Wednesday delivery jumped in Tuesday’s trading as Memorial Day warmth was forecast to give way to temperatures more representative of April. From the Marcellus up through New England, hefty double-digit gains were the rule, but nearly all points were solidly in the black.

All Physical Points Post Losses, Yet Futures Manage Modest Gains

Gas buyers saw little risk in being caught short of gas Tuesday following the extended Memorial Day weekend and prices fell across the board in Friday’s trading.

Tight Weekly Ranges Belie Bulls, Bears’ Struggle For Market Control

Winners were able to maintain a slight numerical advantage over losers, but when the averages were tallied the NGI Weekly Spot Gas Average came in at $4.21, down 6 cents for the week ended May 23. Most points were within a dime of unchanged. Of the actively traded points, Tennessee Zone 4 Marcellus made the greatest gains adding 12 cents to $2.24, but Northeast losses were far greater. Weekly quotes on Iroquois Zone 2 fell 37 cents to $4.22 and were closely followed by a decline of 34 cents to $3.54 at the Algonquin Citygates.