Markets | LNG | Natural Gas Prices | NGI All News Access

August Natural Gas Futures Fail to Sustain Momentum, Falter a Second Day

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |

E&P

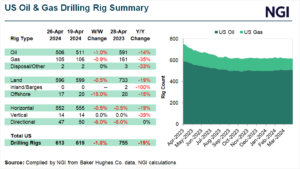

The U.S. natural gas rig count eased one unit lower to 105 for the week ended Friday (April 26), while a decline of five oil-directed rigs dropped the combined domestic tally six units week/week to 613, according to updated numbers from Baker Hughes Co. (BKR). The 105 active natural gas rigs in the United States…

April 26, 2024By submitting my information, I agree to the Privacy Policy, Terms of Service and to receive offers and promotions from NGI.