Markets | Natural Gas Prices | NGI All News Access | Shale Daily

Production Cuts Sustain Natural Gas Futures Rally; Pipeline Maintenance Hammers Waha Cash Prices

Natural gas futures on Tuesday notched a fourth-straight day of gains – albeit barely – on maintenance-induced reductions to already lower production activity.

At A Glance:

- Production hits May low

- Weather forecasts mixed

- LNG steadies above 12 Bcf/d

Coming off a cumulative gain of more than 25 cents over the prior three sessions, the June Nymex gas futures contract tacked on another 1.2 cents day/day and settled at $2.207/MMBtu.

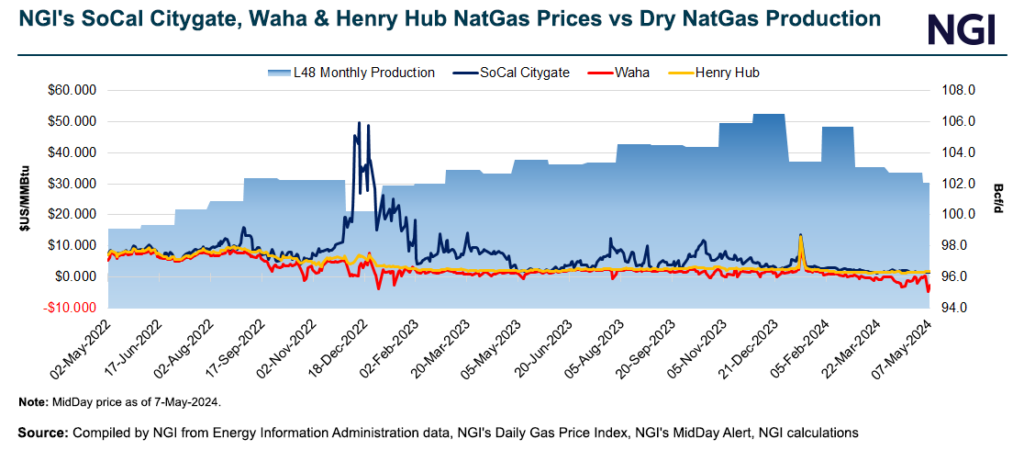

Production clocked in at 94.6 Bcf/d, according to Wood Mackenzie’s Tuesday estimate, down about 3 Bcf/d from the prior seven-day average and off more than 12 Bcf/d from record highs over the past winter.

NGI’s Spot Gas National Avg., meanwhile, gained 10.5 cents to $1.450.

Physical prices were steady in most regions on Tuesday. But, while recovering some ground, prices remained under intense pressure for a second day in West Texas. The biggest bulk of the maintenance-related hits to output were concentrated in the Permian Basin. This restricted supplies nationally but backed up gas in West Texas, creating a fresh glut of supply and depressing prices. Similar conditions weighed on hubs there for much of last month.

Wood Mackenzie said production was down 3.5 Bcf day/day, with Texas accounting for 1.4 Bcf/d of the drop. Most of that was in the Permian. Pipeline maintenance also lowered output in New Mexico, the Northeast and North Louisiana, the firm said.

After plunging nearly $5.00 to kick off the week, Permian cash benchmark Waha climbed back by $1.925 but still averaged negative $2.670 on Tuesday, according to NGI price data.

Most notably, Wood Mackenzie analyst Kara Ozgen said Permian Highway Pipeline (PHP) launched a new maintenance project that was restricting 45% of pipeline capacity. PHP expects the work to extend through this week.

Ozgen said that, for Tuesday and Wednesday, PHP’s nameplate pipeline capacity of 2.65 Bcf/d was expected to be restricted to 1.48 Bcf/d. For the following two days, it could decrease slightly more to 1.45 Bcf/d before an incremental increase to 2.16 Bcf/d over the coming weekend, she said.

“Should all go according to plan, PHP will return to full capacity on May 13,” Ozgen said. More restrictions in the Permian lie ahead. El Paso Natural Gas Co. LLC has plans for maintenance in the basin from May 21-26 that will fully shut-in capacity at a key station, impacting 500,000 MMBtu/d of gas flows, she added.

Paragon Global Markets LLC’s Steve Blair, managing director of institutional energy sales, told NGI that the Permian pullback marked “a large decline.” However, “considering that we have not yet heard any reports of any purposefully reduced production by any of the major producers” aside from repair projects, “it would appear that the Permian maintenance work, although restricting supplies nationally, will more than likely be a short term phenomenon.

“I also think that some of this recent rally, while fundamentally driven, may also have a combination of some short covering and possibly some bargain basement buying,” Blair added.

Speculator Support

Indeed, speculators have been buying into the market to cover short positions, given signs that, outside of the Permian, lighter production has infused a fresh undercurrent to support prices.

“Bullish specs are pushing Nymex natural gas higher,” analysts at The Schork Report said.

Weather, meanwhile, is expected to have a mixed impact on demand in the near term.

National Weather Service (NWS) forecasts show summer-like heat in the South through most of this week, but mostly benign temperatures elsewhere. That is, at least until later in the month when weather patterns could muster more widespread heat.

LNG feed gas demand remains more than 2 Bcf/d off of capacity amid prolonged maintenance events at liquefied natural gas facilities. But work at Freeport LNG in Texas, where some of the most significant work developed in recent weeks, showed signs of significant progress. Volumes at the facility picked up more than 1 Bcf/d to start this week.

“The key question is, when will the short-term rally run out of fuel? With building heat across Texas and the Southeast, maintenance on the Permian Highway Pipeline curbing gas production, and returning LNG feed gas at Freeport, however, fundamentals may remain supportive,” said EBW Analytics Group’s Eli Rubin, senior analyst.

“Technical short covering also often takes a few sessions to run its course,” Rubin added. “Although a short squeeze could catapult gas prices even further, the current rally runs the risk of overextending too fast, too soon to be sustainable.”

The next U.S. Energy Information Administration (EIA) storage report, due Thursday and covering the week ended May 3, could provide more information about the extent of impacts from lighter production. NGI modeled a 77 Bcf build. That compares with a five-year average increase of 81 Bcf.

EIA reported an injection of 59 Bcf for the week ended April 26. It was well below historical results, reflecting the lower supply. EIA said the five-year average increase was 72 Bcf.

The latest build lifted inventories to 2,484 Bcf. That put stocks 35% above the five-year average, but the surplus did decline by two percentage points from the prior week.

Spot Prices

Outside of West Texas, next-day cash prices mostly crept upward, supported by the lower output and bouts of cool air in the Mountain West and chilling storms in the Midwest.

In the Rockies, El Paso San Juan climbed 16.0 cents day/day to average to $1.360, and Opal rose 4.0 cents to $1.470.

Chicago Citygate gained 6.0 cents to $1.660, while elsewhere in the Midwest, Joliet advanced 6.5 cents to $1.655.

Looking ahead, NWS data showed a bout of seasonally intense heat settling in over the South by midweek, including Texas, with highs in the 90s and low 100s.

Temperatures that were unusually cool in the Rockies were expected to expand to the Northwest, with daytime temperatures as low as the 40s.

While benign temperatures were expected to canvass much of the rest of the Lower 48 – with forecasts calling for more of the same next week – rounds of thunderstorms and chilly air could briefly pepper large swaths of the country this week and next. This could add periodic wrinkles to the weather outlook as the market approaches summer.

Near term, “Wednesday will be another big day in terms of severe weather and risk in the Ohio and Tennessee valleys, but some heavy, gusty and locally severe storms are expected to extend as far to the east as the central and southern Appalachians and the mid-Atlantic coast,” AccuWeather meteorologist Brandon Buckingham said.

AccuWeather estimated more than 125 million people will be at risk for severe weather midweek across the Midwest, South Central states and Appalachia. The East Coast could see storms Thursday.

More intense heat looms, meanwhile, beginning in the West.

Maxar’s Weather Desk said Tuesday that, for the 11- to 15-day time frame, its outlook called for unseasonably warm conditions over the West. Long range forecasts call for more widespread heat late in May and into June.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 2158-8023 |