NGI The Weekly Gas Market Report | Coronavirus | E&P | Infrastructure | Markets | NGI All News Access

Coronavirus Heaps Ill-Timed Pressure on Oil, Natural Gas Supply Chains

The confluence of demand shock, oversupply and ongoing disruption imposed by the coronavirus pandemic is weighing heavily on crude oil and natural gas prices, while important components of the supply chain are handicapped as well — fueling concerns about roadblocks when demand does recover.

Factories and production facilities are closed or operating under strict protocols to safeguard workers. The limits are intended to slow the virus’ spread, but they are impeding output of needed parts and supplies. Travel limitations also hurt companies’ abilities to transport service personnel.

With companies’ output and travel expected to only gradually return as restrictions lift in stages, analysts are concerned that lasting supply chain challenges could hamper natural gas and oil operations into 2021.

This “comes at a bad time for upstream services and equipment suppliers who are still recovering from the last downturn,” Wood Mackenzie researchers said in a report this week. “Just as the upstream supply chain was starting to clamber back to its feet, it now faces the very real threat of collapse.” This, by extension, “poses major challenges for the entire sector.”

Already, Wood Mackenzie notes, “margins are thin and balance sheets stretched with high probability of further consolidation, restructuring and insolvency in the supply market.”

Immediately, the greatest impact on both suppliers and operators is expected curtailment of final investment decisions (FID), given the economic uncertainty and strained budgets. Wood Mackenzie said these decisions could fall back to the levels of 2014-2016. “Most projects being considered for FID in 2020 will be pushed back to 2021 or beyond, at best.”

The wildcard, of course, is the duration of the pandemic and its impact on activity. Protracted pressure would hasten investment cuts in technology, equipment and services. Upstream oil and gas would likely emerge lean and hindered by stubborn supply chain interruptions.

“It will have less capacity to respond to demand growth when the market recovers,” Wood Mackenzie said. While “there may be opportunities for operators to extract minor price concessions in this lean period, the stability of the global upstream supply chain represents a major risk.”

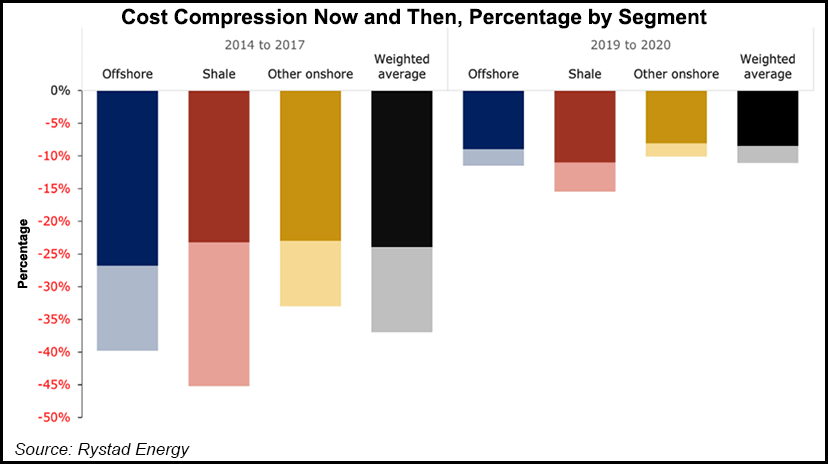

Rystad Energy analysts shared similar concerns. They noted that expense reductions and efficiency initiatives during the last commodities downturn “left little room for further cuts.”

Overall, Rystad expects total cost compression in 2020 to reach 12%, with 9% relating to service prices and only 3% tied to efficiency improvements. “We expect cost improvements within shale of around 16%, in offshore of about 12% and in other onshore of 10%, leaving the cost competitiveness between these segments little changed.” As such, operators “will not be able to rely on the supply chain to help bring down the breakeven costs of expensive projects.”

At the same time, the macroeconomic picture shows few signs of brightening. The U.S. Department of Commerce said Wednesday U.S. gross domestic product (GDP) shrank at a 4.8% annual rate in the first quarter — the first decline since 2014 and the most severe since the financial crisis of 2008. Most economists expect a much steeper GDP drop in the second quarter before the beginnings of a recovery later in 2020.

Chief economist Scott Brown at Raymond James & Associate Inc. pointed to jobless levels as the most glaring example of weakness. About 26.5 million U.S. workers — or roughly one out of seven Americans in the labor force — filed a claim for unemployment benefits in the last five weeks, according to the U.S. Department of Labor, despite trillions of dollars in federal fiscal aid.

“The government will provide extended unemployment benefits and expand eligibility, but the loss of income will, in turn, reduce spending — and that spending is someone else’s income,” Brown noted in a report. While stimulus programs will help, over time, “second- and third-round effects” of layoffs “will add to economic weakness in the near term and hinder the recovery process.”

The speed at which the unemployment ranks have mounted, Brown told NGI, “is unprecedented and staggering.”

A global recession is also underway, analysts said.

Moody’s Investors Service said in a report this week that it expects the advanced economies of the Group of 20 countries, aka G-20, to contract by 5.8% in 2020, with a plunge in GDP during the current quarter. Business failures are likely to mount.

“The contraction in economic activity in the second quarter will be severe and the overall recovery in the second half of the year will be gradual,” said Moody’s Vice President Madhavi Bokil. “Many businesses will struggle to stay afloat in these conditions, and eventually some will close regardless of policy support to the economy.”

Overall demand for fuel likely will slowly improve in the second half of the year in tandem with an assumed relaxation of social distancing measures, Moody’s said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |