NGI The Weekly Gas Market Report | Coronavirus | E&P | Earnings | LNG Insight | NGI All News Access

BP Gripped by Coronavirus, as 1Q Oil Demand Disappears ‘on Scale Never Seen Before’

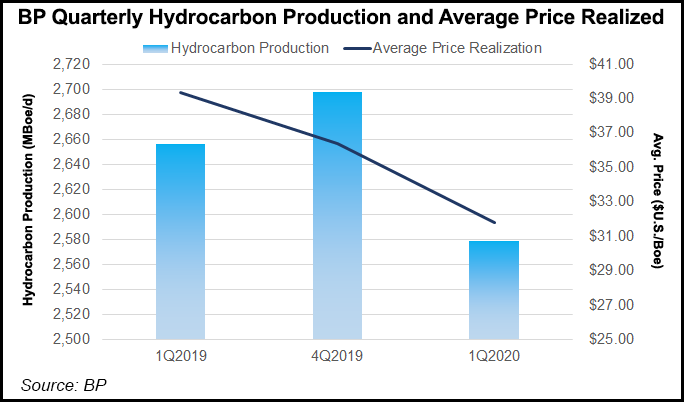

London-based BP plc, kicking off quarterly results for the supermajors, saw its profits drained by two-thirds from a year ago as the impact of the coronavirus took a big bite out of the bottom line.

In an understatement, Group CEO Bernard Looney, presiding over his first quarterly call, said the energy industry “has been hit by supply and demand shocks on a scale never seen before.”

The world is a different place than anyone would have imagined only a few weeks ago, he said during the call with analysts. “The coronavirus pandemic has gripped our world, people are losing their loved ones before their time, many more are afraid for their families, for their finances, their livelihoods, for their futures…and the question I get asked often, will life ever go back to normal?”

BP’s underlying business overall performed well considering, but “things are not getting any easier given the demand destruction we are seeing,” Looney said, pointing to the recent negative pricing for West Texas Intermediate oil, which is “something never seen before.”

“It is a so-called perfect storm, but we are calling on our vast experience of navigating through difficult circumstances.”

BP is anticipating oil demand in the second quarter will decline worldwide by around 16 million b/d, about five times the demand destruction during the global financial crisis in 2008-2009. The coronavirus only added to the “challenge for the oil outlook into the future,” he said.

BP earlier in April reduced capital expenditures (capex) by 25% for the year to around $12 billion, with most of the cuts to the Lower 48 business, BPX Energy.

Upstream CFO Murray Auchincloss said capex could be “flexed down an additional $1-2 billion if necessary.” Most of the capital “interventions” in the upstream “are being made in areas where we do not expect a significant impact on 2020 cash generation at lower prices.

“This includes delaying exploration and appraisal activities, curtailing development activities and lower-margin areas, as well as rephasing or minimizing spend on projects in the early phases of development.

“Overall, we expect these capital interventions to reduce 2020 underlying production by around 70,000 boe/d on an annual basis,” he said. The reduction in output is expected to extend into 2021.

A decline in upstream volumes is not as important as cash flow and returns, Auchincloss said. “The volume decline will just be an outcome of decisions we make, and…we’ll be very, very focused on our scarce capital dollars, focusing that toward the highest return opportunities that we have both in the upstream and the downstream and just very, very focused on margin and returns.”

BP has cut its Lower 48 rig count from 13 at the start of the year to one-to-two going forward.

Thus far, BPX has not shut-in any production in the Lower 48 from its operated businesses “because we couldn’t find a market or we couldn’t find storage,” Investor Relations chief Craig Marshall said. “Right now, we feel pretty good about that…Time will tell on how long the broader picture will recover.

“We’re seeing at least 1 million b/d come out of tight oil in the U.S. this year. It might be higher than that, obviously. People are looking at oilsands and other parts of the world, so I think it’s too early to say what the ultimate response will be, but I think many will struggle to find a home” for supply “and we will see shut-ins increased through the second quarter.”

The BPX volumes may be down, but “that is one of the attractive things about the business,” Looney said. The Lower 48’s unconventional plays allow operators to quickly shift strategy in one direction or another. “But the economics of the business and the investment proposition remains strong in the right environment, and we have the ability to flex it up and down depending on what we see,” Looney said.

[Want to see more earnings? See the full list of NGI’s 1Q2020 earnings season coverage.]

BP initially began to see the impacts to its business in early January from the coronavirus pandemic, Group CEO Brian Gilvary said. Gilvary, on his final BP conference call, announced his retirement in early January; Auchincloss is taking over as CFO.

Energy demand first was swamped in Asia, mostly in China. Further compounding the demand issue was the price war launched between Russia and the Organization of the Petroleum Exporting Countries and its allies (OPEC-plus). In March, Brent and BP’s refining marker margin (RMM) was at levels not ever seen before, while Henry Hub natural gas also hit multi-year lows, Gilvary said.

The imbalance is going to be somewhat improved with the Russia and OPEC-plus agreement to reduce supply, “but it’s unlikely to prevent material supply shut-ins by producers in the near term, some of which may be difficult to reverse…

“Gas markets were challenged before the pandemic following significant growth in supply over the last couple of years,” he said. The onus now falls on improving liquefied natural gas (LNG) demand “and bringing liquefaction margins below operating costs in the United States.”

Gas trading in the first quarter was “strong,” while it was, as expected, below average for oil. There remains “an exceptional level of uncertainty regarding the near-term outlook for prices and product demand,” Gilvary said. “There is a risk of more sustained consequences” depending on how the effects of the pandemic are handled.

In BP’s downstream segment, the fuels marketing business should be significantly lower in key North American and European businesses, where retail fuel volumes have fallen by around half in recent weeks. Demand for aviation fuel is off by around 80%.

As to how the year will shake out, it’s a guesstimate because of the “rapidly evolving situation,” Auchincloss said.

“We now expect to rebalance our sources and uses of cash at the Brent price of below $35/bbl, Henry Hub price of $2.50/MMBtu” on an RMM of $11/bbl in 2021. “The price assumptions for Henry Hub and RMM are around 20% below our prior guidance.”

BP is using “balance point” as opposed to breakeven prices to make clear “about how sensitive we are to things other than Brent, which makes up about 50% of our sensitivity,” Auchincloss said. “RMM and natural gas make up an equal amount as well. So we think the balance point is a much more important point to anchor ourselves” on a balance point of $35 Brent and $2.50 Henry Hub.

“We don’t control the oil price,” said Looney. “We don’t control the gas price. We do control our cost base. We do control our investment. And that’s where we’re very much focused, so we’re confident for sure that we have the levers available to us. It’s not a free pass. It’s not an automatic right, and therefore, we must deliver on what we set out and I hope…you have

confidence that we will.”

BP earned $791 million net ($3.92/share) in 1Q2019, versus $2.4 billion ($12.67) in the year-ago quarter, reflecting a 67% decline. Debt climbed by $6 billion in the quarter to $51.4 billion, while the debt-to-capital ratio, or gearing, rose to 36%.

“Like many companies, we’re doing our best to navigate these unprecedented circumstances as best we can,” Looney said. “We probably won’t get everything right…We can’t know really how things are going to unfold here, but we’re very much in control of the things that we control…

“There is a plan. It’s a clear plan. We’re in action. We are 100% focused on the three things: protecting our staff — the mental and physical health of our staff, supporting our communities, and strengthening the finances of the company.”

BP employees, said Looney, “are coming to work every day, looking out for each other and stepping up where they can to help people, and all the time running the business safely and efficiently…That’s coming with a lot of personal sacrifice, but they’re really rising to the challenge and we’re all very proud of them.”

In addition to BP’s philanthropic efforts, Looney said he and Chairman Helge Lund “believe that this is a mental health challenge as much as a physical health threat, and we are both donating 20% of our salaries for the rest of this year to mental health charities. We are all in this together. I am confident that by supporting each other collectively as a society we will make it through this crisis and rebuild better and stronger.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |