Regulatory | E&P | Infrastructure | LNG | LNG Insight | Markets | NGI All News Access | NGI The Weekly Gas Market Report

Eni Setting Goal to Build Renewables, Natural Gas Stockpile by 2050

Italy-based Eni SpA is taking a cue from fellow European-based supermajors by setting a goal within 30 years to reduce its carbon footprint and make over its portfolio, reducing its oil development and adding more natural gas and renewables capacity.

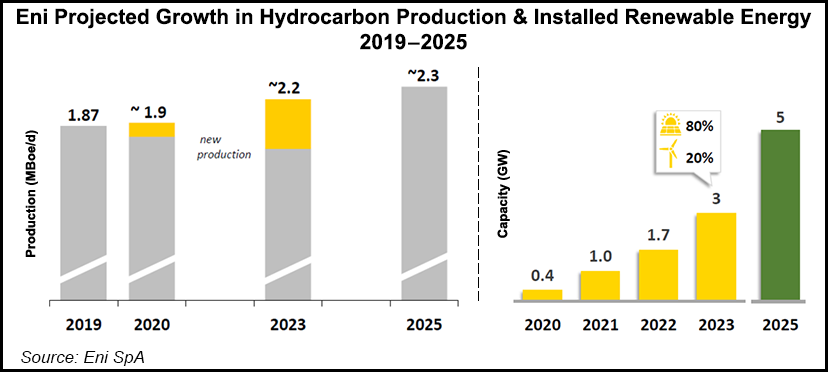

With medium-term goals to 2025 and long-term goals to 2050, Eni plans to increase production to 2025 then begin a sharp transition toward renewables and biomethane. Upstream production is expected to grow at a rate of around 3.5%/year up to 2025.

Oil and gas production then would plateau, “followed by a flexible decline in the following years, mainly for the oil component,” CEO Claudio Descalzi said. By 2050, the goal is to reduce net greenhouse gas emissions by 80%.

“The result will be a portfolio that is more balanced and integrated, and will be stronger for its adaptability and competitive shareholder remuneration,” Descalzi said.

Eni, long a sponsor of initiatives to reduce carbon emissions, last year joined a climate accord with 12 of the largest global producers to begin decarbonizing industrial hubs to reduce methane emissions.

The strategy “represents a fundamental step for Eni. We will set out the evolution of our company in the next 30 years combining the objectives of ongoing development in a fast-changing energy market and a significant reduction in our carbon footprint, a combination considered impossible by many.”

By 2025, plans are to increase the liquefied natural gas (LNG) portfolio by developing new markets and integrating it with the upstream business to enhance the value of equity gas. The portfolio of LNG volumes over the next five years is expected to reach 16 million metric tons/year.

In the longer term, Eni’s Gas & Power business by 2050 is to undergo a “complete transition” with a focus on renewables and biomethane. Eni expects by then to have more than 55 GW of renewables capacity, with more than 20 million retail customers.

“Sustainable” natural gas production would include forest conservation and carbon dioxide (CO2) capture and storage projects that would total more than 40 million tons/year. Electricity production from gas, combined with CO2 capture and storage projects, is to complement renewable power supply.

“This evolutionary strategy will be reflected, in the coming months, in a new organizational structure, whilst management’s long-term incentives have already been modified” by introducing a new environmental, societal and governance objective with a weighting of 35%, management said.

In line with the medium- to long-term strategy, the 2020-2023 action plan includes an “enhanced exploration portfolio” to target 2.5 billion boe in discoveries, with a focus on near-field and proven basins. It also has initiatives to develop frontier basins.

To generate free cash flow to 2023, Eni is targeting average production growth of 3.5%/year from projects already started or that would start up in the four-year plan.

Eni also has published on its website the principles used to define its position on climate change themes. It plans to evaluate its participation in business groups to determine if they align with those principles.

Eni’s strategy mirrors in some ways an ambitious plan set out last month by London-based BP plc, which aims to become a net zero company by 2050 or earlier. BP also dropped its membership last month in three U.S.-based oil and gas groups, citing climate policy conflicts.

Other European majors also are working to reduce their oil and gas footprints and transition to more alternative fuels, including Equinor SA, Royal Dutch Shell plc and Total SA.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |