Shale Daily | NGI All News Access | NGI Archives

Permian Still Biggest Lower 48 Draw for ExxonMobil, Chevron and BP

The Lower 48, and in particular the Permian Basin, will continue to draw growing investments from ExxonMobil Corp., Chevron Corp. and BP plc as they work to improve global natural gas and oil supply, the management teams said during fourth quarter conference calls.

Earnings fell for the supermajors in the final quarter of the year, but output from the U.S. onshore continued to strengthen.

The company has no control over the “short-term price environment,” but it does have control over the fundamentals, ExxonMobil CEO Darren Woods said during the quarterly conference call.

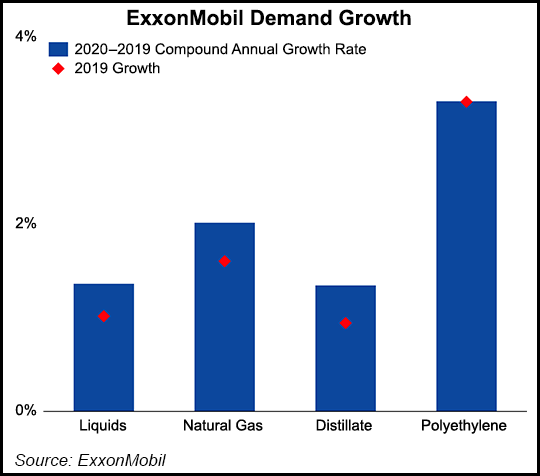

“There’s no doubt that 2019 was a challenging year for a number of our businesses,” he said. The company coped with “near or at 10-year lows on price and margins” for the gas, downstream and chemicals segments. However, “the product demand underpinned in our investments in each of these sectors remains solid.”

ExxonMobil’s worldwide production was nearly flat year/year at 4 million boe/d in 4Q2019. A 4% increase in liquids was offset by a 5% decline in natural gas. Excluding entitlement effects and divestments, however, liquids production increased 2%, driven by a 54% increase in Permian growth, while gas volumes decreased 4%.

The continued ramp-up in the Permian “was a significant driver of this growth,” said the CEO. “We continue to like what we’re seeing in our Permian development, with the organization making very good progress on maximizing resource recovery, efficiently deploying capital and optimizing production. In addition, we’re making good progress in our logistics, refinery and chemical investments that leverage Permian production giving us greater value.”

The $20 billion “Growing the Gulf” initiative launched by ExxonMobil three years ago is designed to expand manufacturing capacity along the Gulf Coast over a 10-year period, fueled by domestic natural gas and oil to expand chemicals, plastics and refining capabilities. Texas and Louisiana projects at about a dozen proposed and existing sites involve investments over a 10-year period.

“We’re also looking at options to pace and to move projects around” to provide outlets for Permian production if it can be done without compromising their long-term value. “I think there is opportunity in that space,” Woods said.

Of course, if the company continues to see “very low margins or cash flow,” Permian activity would have to be addressed. “We’ve got optionality to do that,” Woods said. “We can move some things out and we can also slow down the pace in the Permian. We don’t want to compromise the scale of the development in the Permian…

“There is a balance to be struck there, but we’ve got optionality, and I think as we go through the year to come, we will keep a real close eye on kind of how the market develops and then keep a hand on the levers to make sure that we make adjustments as we need to.”

Extrapolating data from Permian performance in the two sub-basins where ExxonMobil concentrates, the Delaware and the Midland, is not a good model to use, he noted.

“We said it wasn’t going to be a smooth development and that we would see a lumpy progress with respect to the volumes growth…We haven’t seen anything in that development which would suggest anything other than continuing on that path. But again, it will be lumpy.”

In last year’s investor day conference, management forecast it was gearing toward producing about 20,000 boe/d in the Permian, and “that’s clearly on track,” Woods said.

Development in the Delaware is “more difficult” than the Midland, but the Delaware also is much earlier in its development cycle.

“I would tell you we like what we’re seeing in the Delaware and while it is different in the Midland, there is nothing to suggest that the opportunity there is not as great, if not better, frankly.”

For Chevron, the Permian remained a solid performer last year, but cratering natural gas prices led the San Ramon, CA-based major to take a $10.4 billion writedown in the fourth quarter. Most of the one-time impairments ($6.4 billion) were for Appalachia, CEO Mike Wirth said during the quarterly call.

The lack of planning for a worst-case scenario in part was the cause of issues in Appalachia, Wirth said. Chevron in late 2010 spent $4.3 billion to gain entry into Appalachia with its takeover of Atlas Energy Inc.

“At the time of those transactions, we and the world had a different view on natural gas,” Wirth said. While the Marcellus and Utica shales were solid investments at the time, that’s no longer true, he said. Operators have switched to oily plays, and “the Permian and unconventionals have really been a game changer.”

There is a lesson to be learned, Wirth said, about testing merger and acquisition opportunities “against scenarios that are not the then-prevailing view on forward markets.” Chevron had done that when it attempted (and failed) to buy frequent partner Anadarko Petroleum Corp. last year.

“There is a reason that we like Anadarko from a synergy standpoint. There’s a reason we saw a certain value level that we would be willing to transact at, and there’s a reason we wouldn’t go beyond that and that’s because commodity markets are hard to predict…”

Paraphrasing the ever quotable New York Yankees great Yogi Berra, Wirth said, “I think predictions are hard, especially when they’re about the future. That’s certainly true. It’s not lost on us…If you’re going into…a deal with a pretty strong view on commodity price, make sure you take a look at what happens if you’re wrong…”

The oil- and liquids-rich Permian is now the standard bearer for Chevron’s Lower 48 business. Chevron is “maintaining our commitment to capital discipline,” Wirth said, with a flat overall capital budget for the third consecutive year of $20 billion. About $4 billion is budgeted for the Permian.

Chevron has had three strong years of production growth, he told analysts. “The Permian is the biggest piece of that,” as the play is in “full factory production mode right now…And that machine continues to click along very well.

“We’ve got contributions from other shale and tight plays where we continue to invest in both Canada and Argentina, and those are beginning to contribute, not at the same magnitude as the Permian, but certainly strong growth…”

BP rebranded its Lower 48 operations within Denver-based unit BPX Energy in 2018, a decision that has allowed the business to become more efficient and expand, CEO Bob Dudley said Tuesday on his final day as company chief.

U.S. onshore oil production more than doubled last year to 124,000 b/d following the $10.5 billion acquisition of BHP assets in late 2018, which gave BP acreage in the Permian, Eagle Ford and Haynesville shales. Natural gas production rose to 2.175 Bcf/d from 1,705 MMcf/d in 2018.

The Permian is drawing most of development funding, followed by the Eagle Ford, while the gassy Haynesville is barely a slice of the pie because of low gas prices. The Permian alone delivered synergies of $240 million in 2019, “above the target of $90 million we had planned,” CFO Brian Gilvary said during the conference call.

About 12% of BP’s total capital expenditures last year, $1.94 billion, were spent by the BPX business, up from $1.5 billion in 2018.

“Well costs continue to decline in the Eagle Ford and Permian under BP operations, and we are progressing high value, high impact activities as we continue to focus on value over volume,” Gilvary said.

BPX investments are being diverted from “high-volume low-margin gas production to higher margin oil production in the Permian and Eagle Ford basins, where we continue to ramp up activity.”

U.S. natural gas prices continue to be walloped by strong supply growth during a mild winter, as well as “softer demand growth,” said the CFO. Last fall, BP management had said it was bearish on natural gas prices through 2021.

“We expect price to be driven by the balance between continued supply growth versus supply disruption in light of the current challenging pricing environment,” Gilvary said. Underlying production this year within the BPX business is expected to decline from 2019 because of the revamp in the onshore development program, with average output of 200,000-250,000 boe/d.

BPX operated on average 13 rigs in the U.S. onshore last year, with six in the Eagle Ford, four in the Haynesville and three in the Permian.

Further out in 2020, BP expects to see stronger oil demand growth “driven by improving global economic sentiment,” along with “solid U.S. growth” and new supply from Norway, Brazil and Canada, Gilvary said.

In the new era with upstream chief Bernard Looney now at the helm at BP, efficiencies are expected to remain the mantra. BP is facing a “challenging macro environment,” but it remains on track to build out more global oil and gas projects, Gilvary said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |