Markets | LNG | LNG Insight | NGI All News Access | NGI The Weekly Gas Market Report

CME Launches LNG Freight Futures Contracts as Volatility Grows with More Exports

CME Group said this week it is launching liquefied natural gas (LNG) freight futures contracts along three shipping routes later this month, as the exchange works to bring more price transparency to a rapidly evolving global market.

The contracts would allow traders to hedge LNG freight costs, or the rates charged to carry the super-chilled fuel by ship. The contracts would be between Australia’s Gladstone LNG facility and Tokyo; the Sabine Pass LNG terminal in Cameron Parish, LA, and the United Kingdom; and from Sabine Pass to Tokyo. The contracts are set to launch on the New York Mercantile Exchange on Dec. 23.

“Interest in freight futures and options is rising as companies look to manage greater potential volatility in the cost of shipping,” CME said in a related research note last month.

The exchange operator said an increase in U.S. energy exports to Asia and Europe, the International Maritime Organization’s revised rules for marine sector emissions, and an ongoing trade war between the United States and China have sowed additional uncertainty for the global shipping business.

While more tonnage, or the available cargo-carrying capacity, has become available worldwide in the LNG space heading into the new year amid a global supply glut, demand has been robust and is expected to remain strong. One consultant told NGI that the shipping industry has been “pretty volatile,” adding that the contracts would better help those with LNG positions along the Gulf Coast to cover the spread between dominant markets in Europe and Asia.

The United States in particular is seen leading the global gas trade in the coming decades. According to the International Energy Agency’s World Energy Outlook 2019, the country is expected to add by 2025 nearly 200 billion cubic meters, or nearly 7.06 Tcf, of global production through shale and tight gas reserves. More than half of the domestic output likely is destined for export as LNG.

The flood of supplies has seen the export market shift, with the traditional point-to-point model that has served the global LNG trade for decades evolving as a more diverse set of suppliers has entered the market and flexible U.S. contracts have driven more spot cargos, creating a tighter shipping market and more volatility.

CME’s latest freight offering comes after it rolled out a U.S. LNG export futures contract in October. While that has been slow to take off, it was another effort to enhance short-term price discovery and risk management for the Gulf Coast market.

The LNG freight futures contracts are based on assessments that the Baltic Exchange, a London-based market for trading and settling physical and derivative shipping contracts, began offering earlier this year.

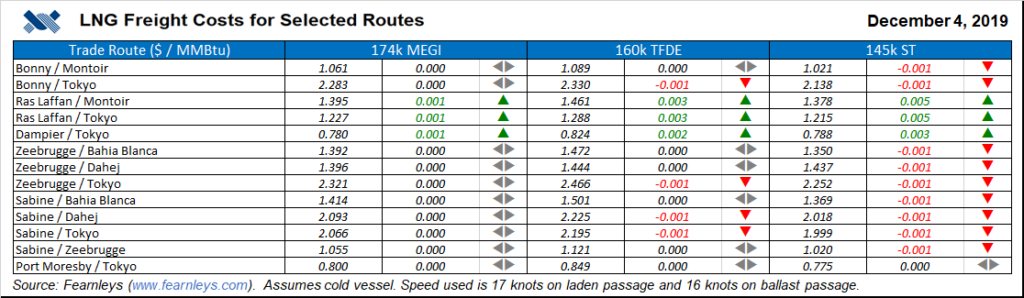

Shipping costs factor heavily into the overall price for LNG depending on the destination. NGI’s LNG Insight recently began publishing daily freight costs along a variety of trade routes, as well as spot vessel rates, or the costs to charter a ship if an offtaker doesn’t already own one.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |