Markets | LNG | LNG Insight | NGI All News Access

Polar Blast’s Exit Leaves Natural Gas Forwards Spiraling Lower; Long-Term Outlook Bleak

With fingers and toes already starting to thaw from the recent Arctic blast, and weather models unclear whether sustained frigid air would return for the rest of November, natural gas bears regained control of the forwards market this week.

December prices plunged an average 22 cents from Nov. 7-13, January tumbled 23 cents and the balance of winter (December-March) dropped 20 cents, according to NGI’s Forward Look.

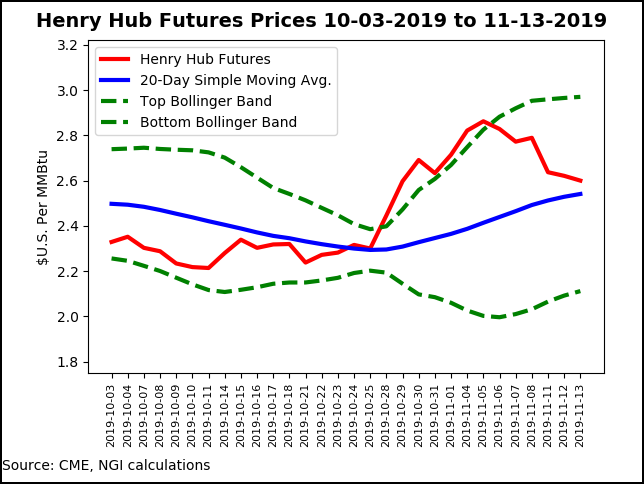

The move lower was to be expected given the sharp rally that had ensued over the previous two weeks, which resulted in the December Nymex futures contract surging more than 40 cents to close in on $2.90. But with moderating medium-term outlooks at the start of the week, the prompt month contract gave back 17 cents between Nov. 8 and 16 to settle at $2.600. January fell to $2.692 and the balance of winter landed at $2.620.

Despite the moderating outlook, models became increasingly at odds in the last couple of runs, with the American model pointing to much stronger demand over the next 15 days and the European model not showing nearly the intensity of cold.

There were some sizable moves in the overnight weather models, however, with the Global Ensemble Forecast System (GEFS) showing much less cold relative to its very cold runs previously, while the European data showed a notable colder shift. But at the end of the day, “this simply brought the models into better agreement”, as the GEFS had been some 30 gas-weighted degree days colder than the European model, according to Bespoke Weather Services.

“We felt the answer likely was in the middle, which is now where the model consensus sits,” Bespoke chief meteorologist Brian Lovern said.

An interesting theme in the modeling is a subtle trend toward more emphasis again on the Pacific side of the pattern as the main driver, and a little less on the Atlantic side, according to Bespoke. This still keeps the late-month pattern very tricky, but if blocking winds up weaker on the Atlantic side, the projected shift in tropical forcing might more easily bring about some warming into early December.

“That is beyond the 15-day modeling, however, so confidence is lower for now,” Lovern said.

While it was clear that bullish optimism had outpaced fundamentals, the speed with which Nymex futures have reversed lower suggests that speculators continue to short natural gas, according to EBW Analytics Group. From Oct. 22 to Nov. 5, cold weather and the associated surge higher in Nymex futures led to short positions created by 111,000 contracts, carrying the rally higher than warranted by fundamentals.

“…it is highly likely that speculators have smelled weakness and pounced to lead the December contract lower,” EBW said.

Fundamentally, the projected natural gas storage trajectory leads to 1,543 Bcf end-of-March storage, a number that is likely 200 Bcf oversupplied in weather forecaster DTN’s most-likely weather scenario. EBW believes the market will target closer to 1,350-1,400 Bcf in end-of-March storage.

“Although a meager premium may remain warranted this early in the winter, particularly with the potential for a very cold January and February still on the table, absent an extreme cold outcome, prices are likely to remain biased downward,” the firm said.

To be sure, the latest government storage data failed to give market bulls much sway. The U.S. Energy Information Administration (EIA) reported a modest 3 Bcf injection into storage inventories for the week ending Nov. 8.

Some market observers viewed the report as bearish considering the wide range of expectations in which some analysts had called for a withdrawal. Ahead of the EIA report, estimates had clustered around a range between minus 9 Bcf and plus 9 Bcf, with major surveys suggesting stocks might finish near-even week/week. NGI’s model predicted a 4 Bcf injection.

Bespoke said the 3 Bcf build is reflective of “more tightening than we have seen in quite awhile” although the firm ultimately viewed it as “rather neutral overall, as it does show that weather can tighten the market when strongly biased to the cold side…”

Market observers on energy chat platform Enelyst.com wondered if next week’s EIA would be more reflective of the chilly temperatures so far this month, with storage operators likely stocking up last week in preparation for the recent Arctic blast.

“We are definitely in that camp,” said EBW economist Eli Rubin. If December/January turn out to be mild, the pricing sell-off “could be fierce.”

Broken down by region, the Midwest and Pacific reported slight draws of less than 5 Bcf, as did nonsalt facilities in the South Central, according to EIA. Salts added 10 Bcf into the region’s inventories, while the Mountain and East regions posted saw no change in stock levels week/week.

Total working gas in storage stood at 3,732 Bcf, 491 Bcf higher than last year at this time and 2 Bcf above the five-year average, EIA said.

Even in an extreme cold weather scenario, it appears the market has largely shrugged off the possibility of a storage squeeze this winter. That’s because production continues to sit near highs and is on pace to average 10% higher year/year at 92.1 Bcf/d, according to the EIA’s latest Short-Term Energy Outlook.

Genscape Inc. estimated that production hit a new high of 94.32 Bcf/d on Nov. 9, besting the previous high of 94.11 Bcf/d logged on Nov. 3. By Wednesday, however, about 1.3 Bcf/d of that output had been curtailed by freeze-offs. Since freeze-offs started hitting in late October, there has been a cumulative 7.9 Bcf of production impacted by freeze-offs.

“Due to the early start (the earliest we had previously seen freeze-offs was Nov. 11, 2014) and progressively greater impact freeze-offs have from the growth of liquids-rich plays, this is by far the highest accumulation of production impacted in a winter-to-date,” Genscape senior natural gas analyst Rick Margolin said.

By Friday, Bespoke’s estimates showed production beginning to crawl back, still off about .75 Bcf/d from highs but likely to continue climbing through the weekend.

Meanwhile, Lower 48 demand was on the downswing and failed to bring about any new records even during the coldest period of the polar blast. Tuesday’s demand reached 106.9 Bcf/d, which was short of the 108 Bcf/d Genscape had forecast and shy of the 107.6 Bcf/d record set on Nov. 27, 2018.

Liquefied natural gas (LNG) exports have also been volatile, with nominations data for Thursday indicating volumes to be just a tick below the 7 Bcf/d mark, about 0.6 Bcf/d off the peak achieved on Nov. 2, according to Genscape.

“While feed gas to Corpus Christi has jumped back up, flows to Freeport have receded,” Margolin said.

On Nov. 6, feed gas volumes to Freeport reached a record 729 MMcf/d, but on Nov. 9 plummeted to 262 MMcf/d and have remained below the 0.3 Bcf/d mark since. “This type of volatility at Freeport has been somewhat common as Train 2 spools up to begin commercial LNG production by end of year,” Margolin said.

As for exports to Mexico, Genscape sees a seasonal decline already starting to take place as flows have come down appreciably from the handful of days in early October when prints were in the 5.8 Bcf/d range. U.S. pipeline exports to Mexico are averaging just shy of 5.27 Bcf/d so far this month to date, which is line with the firm’s forecast of 5.28 Bcf/d.

“Those early October volumes came on the heels of the startup of the new Sur de Texas-Tuxpan pipeline and were very surprising to us, being nearly 0.4 Bcf/d greater than our forecast for October. However, since Oct. 10, flows have been declining steadily. By the time October closed, flows for the month ended up averaging 5.51 Bcf/d, just 63 MMcf/d above our forecast,” Margolin said.

Genscape’s forecast has called for year/year growth in exports to Mexico with new infrastructure enabling displacement of existing Mexican supplies from LNG and production declines, as well as some demand growth. However, the firm has been calling for lower U.S. exports than other estimates based on its belief that Mexican production is/will not decline as rapidly as many think, “nor is there quite as much demand growth as has been seen in recent years,” Margolin said.

With the early-season Arctic blast already moving out, the stage was set for dramatic losses across the high demand region of the Northeast. Although a reinforcing cold shot was expected to race across the northeastern United States beginning Friday, the pattern for the coming week is forecast to bring a return to more seasonal conditions.

After trading well above $6 earlier in November, the December contract at Algonquin Citygate plunged 63 cents between Nov. 8 and 13 to reach $5.283, according to Forward Look. January also lost 63 cents to finish at $7.914, and the balance of winter tumbled 55 cents to $6.403. Summer prices were down just 4 cents to $2.45.

Similarly pronounced declines were seen across New England, where AccuWeather shows temperatures fluctuating in the 40s and 50s for most of the next several days.

At Transco Zone 6 non-NY, December dropped 29 cents between Nov. 8 and 13 to reach $3.297, but January slipped just a penny to $5.442 and the balance of winter fell a dime to $4.167, Forward Look data show. The summer was down 5 cents to $2.08.

In Appalachia, Texas Eastern M-3 prices posted hefty losses across the curve as the pipeline released its Winter Storage Withdrawal Plan, which outlines maximum withdrawal limits for specific periods throughout the winter for each of its storage customers.

Texas Eastern M-3 December slid 68 cents to $3.54, January dropped 56 cents to $5.847 and the balance of winter tumbled 41 cents to $4.496, according to Forward Look. Summer shed a nickel to land at $2.05.

Several pipes in the East took precautionary measures in anticipation of the recent cold spell. Transcontinental Gas Pipe Line (Transco), Tennessee Gas Pipeline and Southern Natural Gas Co. were among the pipelines that declared operational flow orders, with Transco declaring it specifically for Zones 4, 5 and 6.

Both Texas Eastern Transmission and Algonquin Gas Transmission (AGT) suspended no-notice service for gas day Nov. 13, and AGT planned to increase capacity at its Southeast and Cromwell compressors to 1,824 MMcf/d and 1,296 MMcf/d by Nov. 16. Dominion had cut all interruptible transportation and other non-firm services within its PL-1 system.

Although stout declines were seen across the United States as rampant production, healthy storage levels and moderating weather outlooks pressured the market, record-low storage inventories in western Canada aided in keeping forward prices in the region relatively supported.

NOVA/AECO C December fell just 5 cents from Nov. 8-13 to reach $1.916, according to Forward Look. January dropped 6 cents to $1.845 and the balance of winter slipped 5 cents to $1.761. Summer also was down just 5 cents to $1.27.

The pared down losses come as demand is averaging its second strongest month-to-date level in the past 12 years, according to Genscape. Furthermore, production is down 0.23 Bcf/d versus the same period last year, which is being almost entirely made up for by a year/year increase of withdraws from already-low storage inventories.

Western Canadian natural gas inventories drew by 4 Bcf this week, relative to a five-year average 2 Bcf draw, reducing total inventories to 327 Bcf, or 22% below historical norms, according to Tudor, Pickering, Holt & Associates (TPH).

The last round of scheduled maintenance for the season on TC Energy’s Nova Gas Transmission Co. Upstream James River kicked off on Oct. 30, just as the pipeline’s Temporary Service Protocol rolled off, “crimping supply in the region and preventing an AECO fallout prior to furnaces needing to be kicked into high gear,” TPH analysts said.

AECO spot pricing for the first two weeks of November has averaged just north of C$2.80/Mcf and the winter strip is currently sitting at C$2.32/Mcf, or a US78 cents/MMBtu differential to Nymex pricing, according to TPH.

“But, with maintenance on the system ending Thursday and with temperatures expected to stay above freezing for the remainder of the month, we could see pricing soften in the near-term,” analysts said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |