August Not So Kind To NatGas Bidweek Bulls

August bidweek could aptly be characterized as “You win some, you lose some,” as prices gave back some of the 86-cent gain market bulls enjoyed in July bidweek pricing. NGI”s National Bidweek Average fell 23 cents from July to $2.43, which is only 13 cents below the August 2015 bidweek average.

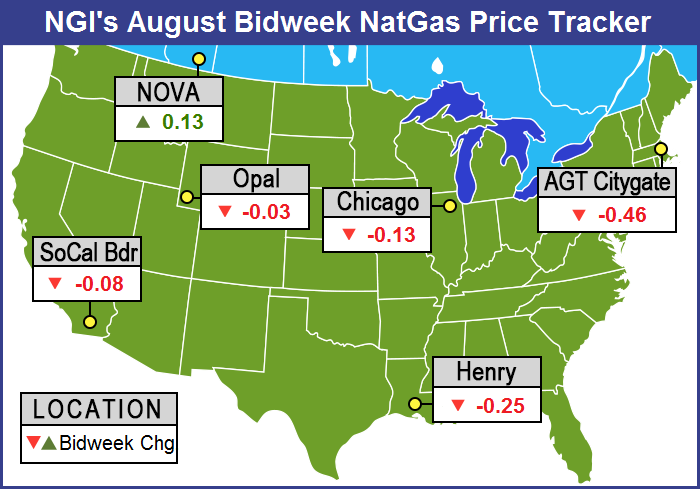

Some nasty declines in the Northeast and Appalachia were partially offset by relative strength in the Rockies and California, but outside of a few points that climbed into positive territory, most locations fell by about a quarter. Of the actively traded individual market points, Nova/AECO C came out on top with a gain of 13 cents to $C2.31 and swirling the bottom of the barrel were Dominion North down 76 cents to average $1.27 and Tetco M-3 Delivery down 73 cents to $1.38.

Regionally Appalachia and the Northeast were the biggest losers with drops of 65 cents and 45 cents to $1.42 and $2.22, respectively. The Rocky Mountains fell the least with a loss of just 2 cents to average $2.48.

The Southeast shed 27 cents to $2.61 and South Louisiana found itself 25 cents lower at $2.62. The Midwest was only slightly better with a drop of 20 cents to $2.62.

South Texas and East Texas came in with declines of 19 cents and 14 cents to $2.62 and $2.65, respectively.

California dropped a dime to $2.80 and the Midcontinent was also a dime lower at $2.55.

August futures went off of the board at $2.672, registering 24.5 cents less than the July contract expiration.

As bidweek drew to a close Friday, physical natural gas for Monday delivery took a solid jump as it attempted to catch up with Thursday’s futures move of more than 20 cents. Gains in the Rockies, Northeast and Gulf were easily able to offset soft California pricing and a weak Southeast.

The NGI National Spot Gas Average for Monday delivery added 13 cents to $2.66, but the Northeast featured average increases of more than 30 cents. Moves in the physical market were easily able to overtake what seemed to be somnambulant futures trading. At the close Friday, September had managed a three-tenths of a cent gain to $2.876 and October had risen eight-tenths of a cent to $2.917.

Traders didn’t vary much from their normal bidweek purchases. “We didn’t need to buy very much, and we are on track for what we normally do,” said a Midwest utility buyer. “We managed to get a lot of our gas out at the end of winter to make room to put some gas in. We are on kind of a normal pace.”

“We bought some at Demarc and Ventura first of the month Index. Just carrying on as always.”

Other buyers reported buying gas at the Wednesday futures settlement close, which proved to be a timely buy before prices surged Thursday following the Energy Information Administration (EIA) storage report.

“We had a negative basis going on for Michcon and Consumers,” a Michigan marketer said. “On Michcon we paid $2.70 and on Consumers we paid a $2.662 and a $2.6425. Given the rise in prices it looks like that was a good deal. Prices just went up, up, up.”

Southern California prices Friday were all over the map as temperatures were forecast to be at more normal levels and SoCal pricing returned to more normal levels.

Gas at Malin for Monday delivery rose 8 cents to $2.77, and PG&E Citygate deliveries added 15 cents to $3.26. SoCal Citygate prices plunged 18 cents to $3.02, and gas priced at the SoCal Border shed 19 cents to $2.93.

Gas on El Paso S. Mainline/N. Baja fell 9 cents to $3.05, and Kern Delivery gave up 19 cents to $2.95.

Once temperatures subside, gas prices will usually follow. “Today [Friday] is a good example of gas for the 1st of August. PG&E Citygate is at $3.26 and SoCal Border Avg. is about $3.05. PG&E is over SoCal and once the heat goes away everything is going to switch back around,” said Jeff Richter, principal with EnergyGPS, a Portland, OR-based power and gas consulting firm.

“Socal will go right back to the [Henry] Hub. It’s a little over now, but come September and October it will be tight.”

Top traders are looking for a spot to sell. “We have indicated this week that the one- to two-week outlooks didn’t appear to justify September values below the $2.70 level,” said Jim Ritterbusch of Ritterbusch and Associates. “With the eastern half of the U.S. apt to see some significantly warmer than normal trends developing within the six- to 10-day time window, some additional sharply reduced injections would appear to lie ahead well into next month.

“[Thursday’s] 17-Bcf injection was well below average industry ideas as well as our own outlook for a 31-Bcf build. As a result, the surplus against five-year averages shrunk another 44 Bcf and is likely to see a similar reduction again in [this] week’s data. This appeared to offer a setting for [Thursday’s] price spike as the market responded assertively to the upside off of the bullish combo of a comparatively modest injection and bullish adjustment to the temperature outlooks.

“We had been looking for a bearish storage figure that would offer a buying opportunity below the $2.60 level. However, [Thursday’s] advance forces us to consider the short side of the market given our extended perception of the choppy/sideways trade with nearby values generally fluctuating between the $2.70-2.85 level across most of next month. In sum, we are staying in a neutral camp for now but may look to approach the short side on a further price advance toward the highs seen at the start of this month.”

When EIA reported a 17-Bcf storage injection for the week ending July 22, about 9 Bcf less than what traders and analysts were calculating, September futures bounded higher. By the close Thursday, September had tacked on 21.3 cents to $2.873 and October was higher by 20.0 cents to $2.909.

“We were hearing a number from 24 to 28 Bcf and 26 Bcf was kind of the average,” a New York floor trader told NGI. “That number coming out so low gave confidence to anybody who was long, and anybody who got caught short got burned.”

Analysts were pointing at a miscalculation of power burn. “The smaller than expected 17-Bcf net injection for last week was less than expected and bullish compared with the 52-Bcf five-year average for the date,” said Tim Evans of Citi Futures Perspective. “It was a second consecutive bullish miss, adding to the likelihood that power sector demand has been more sensitive to summer heat than anticipated, something that will likely carry over into the data for the next few weeks.”

Others were more animated. “Are you kidding me?” said John Sodergreen, editor of The Desk weekly storage survey. “There was some serious activity going on in South Central, but Midwest was about par. The South Central was a greater draw than anyone expected and it’s a situation where there is a lack of transparency and nobody knows what the hell is going on.”

Inventories now stand at 3,294 Bcf and are 436 Bcf greater than last year and 524 Bcf more than the five-year average. In the East Region 18 Bcf was injected and the Midwest Region saw inventories increase by 14 Bcf. Stocks in the Mountain Region rose 3 Bcf, and the Pacific Region was unchanged. The South Central Region, however, fell 18 Bcf.

At some point, lower prices will be colliding with lower production. “Lower 48 dry gas production is off more than 0.5 Bcf/d DOD with large declines in the Gulf of Mexico, Texas and the Rockies,” said industry consultant Genscape in a Thursday report. “Spring Rock’s Daily Pipe Production estimate has today’s volume at 71.8 Bcf/d. GOM production is down more than 0.2 Bcf/d DOD due to offshore losses. Destin receipts from Delta House are down to 74 MMcf/d, a 132 MMcf/d drop from yesterday and the prior 30-day average.

“Evening noms to Transco from Tubular Bells are also off, coming in at 9 MMcf/d after having averaged 47 MMcf/d in the past 14 days. Elsewhere, Texas estimated production is down 148 MMcf/d DOD, and Rockies volumes are off 103 MMcf/d DOD with declines showing in every basin but the Uinta.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1258 | ISSN © 2577-9877 |