E&P | LNG | NGI All News Access | NGI The Weekly Gas Market Report

NatGas Supply-Demand Balance Coming in Low-Price Era, Shell Analyst Says

New demand from U.S. exports and industrial growth in the Gulf Coast region puts the natural gas industry on the verge of a supply-demand balance, according to a Royal Dutch Shell plc analyst, who addressed the LDC Gas Forum Rockies & The West conference Tuesday in Los Angeles.

Shell Energy North America analyst Laird Dyer sees the scenario unfolding in the next few years in a low oil price environment, which he considers a positive, given the continuing reduction in the marginal cost of production for oil and gas in the United States.

Rather than focusing on commodity prices for oil and natural gas, the important barometer is the marginal cost to produce a barrel of oil and a Mcf of gas, Dyer, a Canadian petroleum engineer, said.

“What we have to pay attention to is the marginal cost of production; there are no ‘high’ or ‘low’ prices, but only what is the price relative to what it costs to produce a marginal MMBtu,” he said. “We used to hate high oil prices [in the Arab embargo days]; now we should embrace low oil prices.”

Low energy prices are a good thing for consumers, U.S. manufacturers, and for the U.S. economy overall, Dyer said.

In a wide-ranging talk about domestic shale, gas markets, an emerging north-south gas grid, global oil and hydraulic fracturing (fracking), Dyer predicted that the Gulf Coast will be an international Mecca for industrial development, driven by low U.S. energy prices spawned by abundant shale supplies.

“If you are an international industrial entity that is very energy intensive, you are coming to the Gulf Coast,” Dyer said. “To survive [globally] you have to come to the Gulf Coast for the cheap energy supplies, and the infrastructure and the energy expertise.”

With a ready-made market and access to overseas markets, the United States has a “massive advantage” over other areas in attracting industry to the Gulf, Dyer reiterated several times. He said that after a decade of U.S. energy emphasis on developing more supplies, principally unconventional resources, the focus has now shifted to the demand side, which he thinks will grow substantially.

He is bullish about the prospects for the five current U.S. LNG export projects under/nearing construction, noting if global oil prices stay at or above $30-35/bbl, the LNG exports are economically viable. All of the U.S. export projects are priced at Henry Hub, he said.

“That’s 9.2 Bcf/d of incremental demand [for U.S. producers],” Dyer said, noting that is on top of current U.S. demand of 75 Bcf/d. That amounts to a 12% jump that he sees developing “really quickly.”

Mexico has added 3.5 Bcf/d of import capacity, doubling its capacity to 7 Bcf/d it can take from the United States, he said. “They have another 5.8 Bcf/d planned for coming in by 2018. Everyone sees the amounts of U.S. exports to Mexico doubling in the next three to five years.”

Dyer is also bullish about the growth in U.S. industry, which he said is adding about 750 MMcf/d of incremental demand annually.

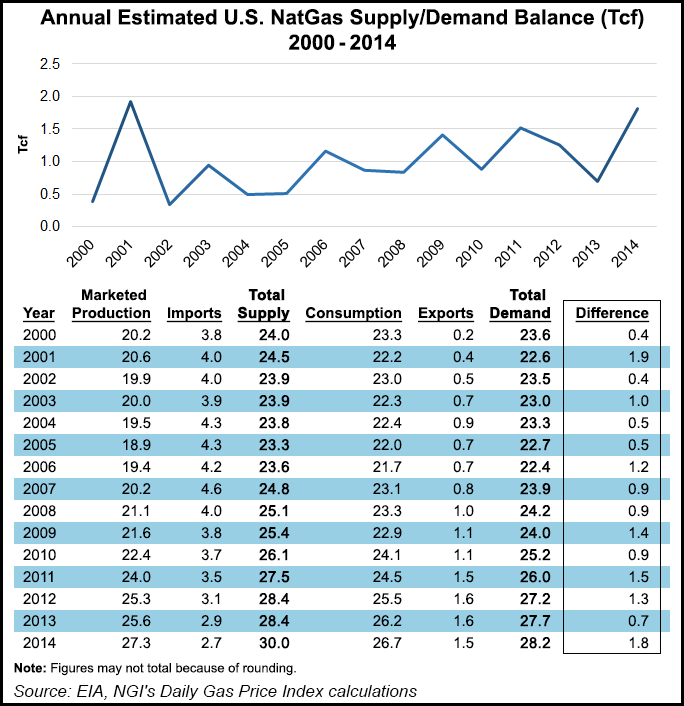

The United States was oversupplied by roughly 1.8 Tcf in 2014, the highest such total since 2001, according to NGI estimates from Energy Information Administration data. Marketed production of 27.3 Tcf, combined with 2.7 Bcf in gross imports, provided 30.0 Tcf of U.S. supply in 2014, versus total demand of 28.2 Tcf, comprised of consumption of 26.7 Tcf and gross exports of 1.5 Tcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |