Markets | LNG | NGI All News Access

United States to Be Net Exporter of NatGas by 2017, Study Finds

Demand for natural gas in the United States is growing at the fastest pace since the early 1970s, but pipelines to Mexico and construction of liquefied natural gas (LNG) terminals on the nation’s shorelines will help turn the country into a net exporter of gas by 2017, according to a study released Thursday by CoBank.

“Going forward, significant demand growth will usher in a new era for domestic natural gas markets — one that is defined by the growing influence of international markets as the U.S. becomes a net exporter of natural gas,” said Taylor Gunn, a senior economist at CoBank and author of the report.

The promise of low-cost, reliable natural gas supplies has spurred major investments by end-users, and the demand for domestic gas will grow 25% over the next five years, with exports accounting for more than half the growth, according to the report.

“Natural gas exports will account for over half of future demand growth, increasing by 11.1 Bcf/d during the next five years. This represents a 270% growth in exports from 4.1 Bcf/d in 2014 to 15.2 Bcf/d in 2020. The majority, or approximately 7.8 Bcf/d, will be from LNG exports, followed by an additional 2.5 Bcf/d of pipeline exports to Mexico, and 0.85 Bcf/d of additional exports to Canada.

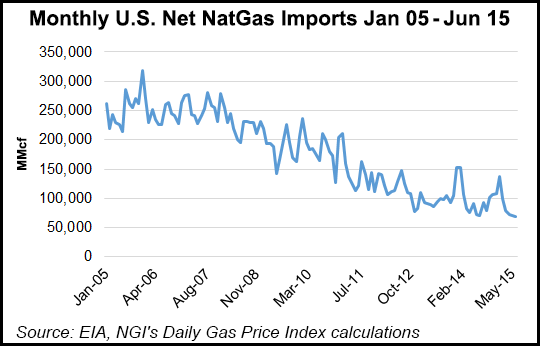

“As a result of growing exports coupled with declining imports, the U.S. will become a net exporter of natural gas within the next two years.”

That’s the same conclusion the Energy Information Administration (EIA) reached in its Annual Energy Outlook 2015 earlier this year (see Daily GPI, April 14). EIA expects natural gas export growth to continue after 2017, with net exports in 2040 ranging from 3.0 Tcf in EIA’s Low Oil Price case to 13.1 Tcf in the High Oil and Gas Resource case. And the agency said it expects the United States to pivot from an overall net energy importer to a net exporter by 2030.

CoBank expects industrial demand for gas, which has been on the rise since bottoming out in 2009, to continue that trend, with consumption likely to increase by 3.5 Bcf/d to 24.5 Bcf/d in 2020. The power generation sector’s fuel consumption ledger is being rewritten by the retirement of a significant number of coal-fired units. The Environmental Protection Agency has estimated that the sector will burn 24.7 Bcf/d of natural gas in 2020, about 10% more than the 2014 level.

But an analysis of new gas-fired projects under construction or in advanced stages of development, as well as coal-to-gas conversions and higher utilization rates of existing gas-fired units, paints a different picture, according to CoBank: “the power sector is likely to increase by 23%, or 5 Bcf/d, from 22 Bcf/d in 2014 to roughly 27 Bcf/d in 2020.”

Texas and the Gulf Coast would remain the nation’s center of gas consumption, thanks to new LNG export facilities, growing pipeline exports to Mexico, increased gas-fired power generation and an expanding petrochemical industry, CoBank said. The northeast and its shale plays would remain the dominant producers of natural gas. But Northeast gas producers remain constrained and “the regional gas glut in the Northeast will remain in place until late 2017 or late 2018. Hence, Northeast regional prices will remain decoupled from the Henry Hub until then, driven by strong production growth and localized pipeline congestion rather than Gulf Coast market conditions.”

CoBank is a $107 billion cooperative bank that provides loans, leases, export financing and other financial services to agribusinesses and rural power, water and communications providers.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |