Bulls Enjoying Modest Gains Following Storage Stats

Natural gas futures crawled higher following the release of government inventory figures showing an increase in working gas storage that was less than what the market was expecting.

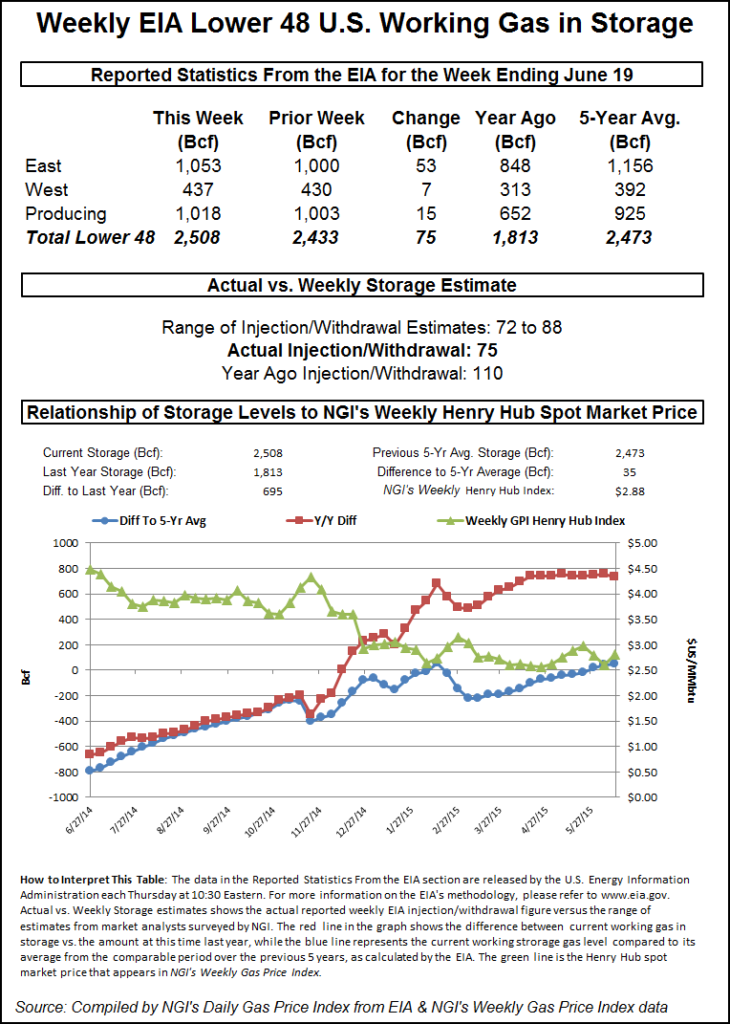

For the week ended June 19, the Energy Information Administration (EIA) reported an injection of 75 Bcf in its 10:30 a.m. EDT release. July futures rose to a high of $2.829 after the number was released and by 10:45 a.m. July was trading at $2.784, up 2.5 cents from Wednesday’s settlement.

Prior to the release of the data, analysts were looking for an increase closer to the upper 70 Bcf area. IAF Advisors calculated a 76 Bcf increase, and Citi Futures Perspective was looking for a build of 83 Bcf. A Reuters poll of 25 traders and analysts showed an average 77 Bcf with a range of a 72-88 Bcf injection.

“Guys were looking for a 76 Bcf to 78 Bcf build, and prices burst higher but are now settling in,” said a New York floor trader. He noted that Thursday was also options expiration and for those who had sold $2.75 July calls, they were now sporting a loss of 3.4 cents.

Tim Evans of Citi Futures Perspective said, “The 75 Bcf in net injections was below the median expectation and tends to reinforce the idea of a modest tightening in the background supply-demand balance. Anecdotally, maintenance work may be limiting supply while power sector demand is on the rise with the closure of some coal-fired power plants.”

Inventories now stand at 2,508 Bcf and are 695 Bcf greater than last year and 35 Bcf more than the five-year average. In the East Region 53 Bcf was injected, and the West Region saw inventories increase by 7 Bcf. Stocks in the Producing Region rose by 15 Bcf.

The Producing Region salt cavern storage figure was unchanged at 295 Bcf, while the non-salt cavern figure increased 14 Bcf to 722 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |