Saudi Arabia’s state-owned oil and gas company is raising its capital spending, but whether it increases production is another story despite record profits in the first quarter.

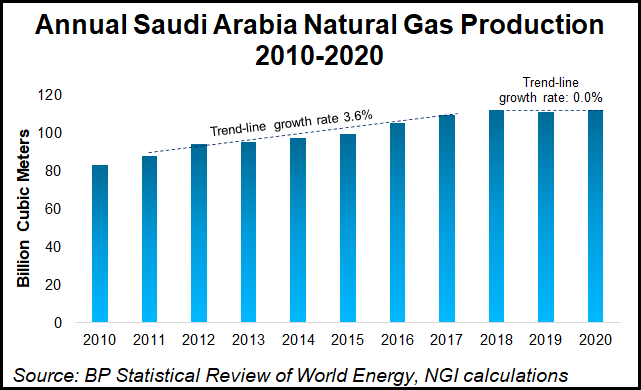

Unlike most of its oil and gas peers, Saudi Arabian Oil Co., aka Aramco, plans to increase this year’s capital expenditures to $40-50 billion from nearly $32 billion in 2021.

“Energy security is vital, and we are investing for the long term,” CEO Amin H. Nasser said. Aramco is expanding “oil and gas production capacity to meet anticipated demand growth and creating long-term shareholder value by capitalizing on our low lifting cost, low upstream carbon intensity, and integrated downstream business.”

Aramco, majority owned by the royal family, also has an array of environmental, social and...