Houston-based Apache Corp. on Thursday signaled it will boost upstream capital spending this year by 11% to $1.1 billion over 2020, but most of the funds are earmarked for overseas, not in the Lower 48.

The decision to hike capital expenditures (capex) comes after the 4Q2020 results provided “a positive conclusion to a challenging year,” CEO John J. Christmann IV said during a conference call Thursday. He discussed results for 2020 and provided an encouraging outlook for 2021.

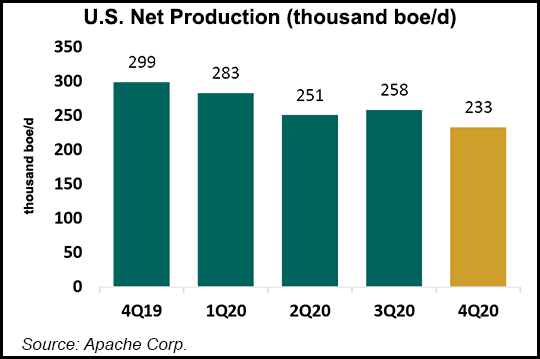

As 2020 came to a close, “commodity prices held firm, and we executed well on our production, capital spending and costs objectives while also delivering promising exploration results internationally.”

Moving quickly and efficiently proved a winning strategy last year, a devastating one...