Permian Basin-to-Gulf Coast pipeline giant Altus Midstream Co. has agreed to merge with fellow West Texas operator BCP Raptor Holdco LP in an estimated $9 billion transaction.

The combination would operate 2 Bcf/day of cryogenic natural gas processing facilities in the Permian Delaware sub-basin of West Texas, with more than 850,000 acres under fee-based, long-term dedications.

The pro forma enterprise would provide residue gas, natural gas liquids (NGL), crude oil and water midstream services. Measured by processing capacity, the combination would become “the largest natural gas processor in the Delaware Basin and third largest across the entire Permian Basin.”

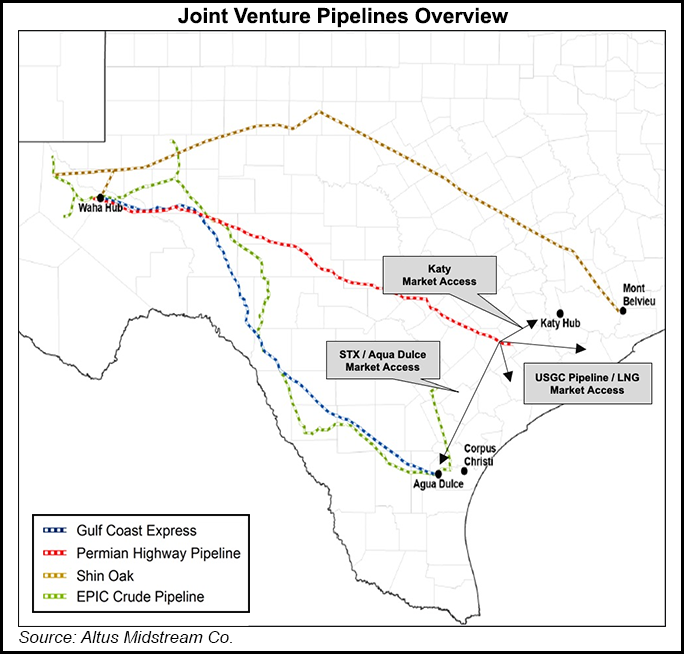

Houston-based Altus, 79% owned by Apache Corp., owns gathering, processing and transmission assets that include...