Infrastructure | LNG | LNG Insight | NGI All News Access | NGI The Weekly Gas Market Report

Alaska Project Eyes Exporting LNG to Asia Markets Using Icebreaker Tankers

ExxonMobil Corp. may hop on board a new plan to ship stranded Alaska natural gas from the Point Thomson field to Asian markets using icebreaker ships.

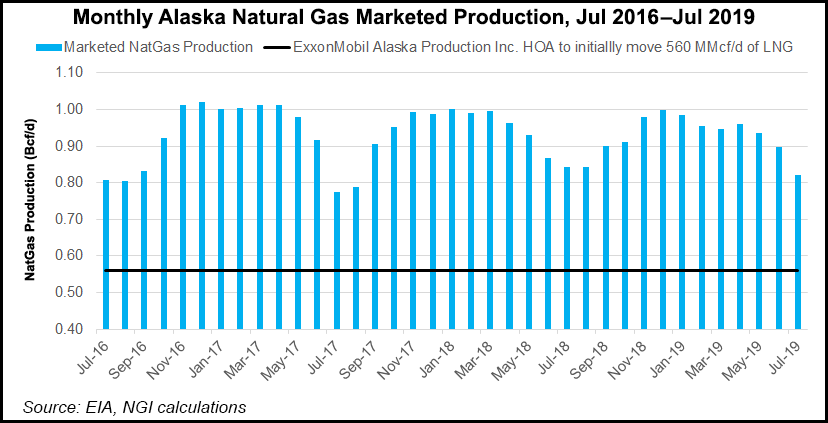

Subsidiary ExxonMobil Alaska Production Inc. on Wednesday signed a heads of agreement (HOA) to initially move 560 MMcf/d of liquefied natural gas (LNG) via recently formed Qilak LNG Inc., a Lloyds Energy company. Former Lt. Gov. Mead Treadwell is CEO.

“The Qilak LNG 1 Project would deliver on Alaska’s long-held goal of commercializing North Slope natural gas,” said Treadwell. “With this HOA and our recently completed pre-feasibility study, Qilak will now begin extensive feasibility efforts, including preliminary permitting…”

The offshore liquefaction and loading facility as initially designed would use icebreaking carriers to move supply to thirsty markets. A final investment decision is expected by 2021, Treadwell said.

Qilak plans to capitalize on recent developments in Arctic LNG technology to directly export gas from the North Slope, a concept that could reduce capital costs versus projects that require long-distance pipelines and large minimum orders.

Dreams of moving oil and gas from Alaska through Arctic waters have been pondered since the 1980s, but melting ice in recent years has made the prospect more feasible.

Phase 1 would have an export capacity of 4 million metric tons/year (mmty), about one-third the size of many Gulf Coast projects, but there is an option to add capacity in future phases.

Asia is the target market, and the company also is in “discussions in several Asian countries to engage potential stakeholders” to support the project.

“ExxonMobil sees the development of the Qilak LNG 1 Project as an opportunity to develop Alaska’s gas resources,” said ExxonMobil Alaska President Darlene Gates. “As the largest holder of discovered gas resources on the North Slope, ExxonMobil has been working for decades to tackle the challenges of bringing Alaska’s gas to market.”

The Alaska Oil and Gas Conservation Commission has estimated that collectively, Prudhoe Bay and Point Thomson could produce more than 9 Bcf/d on a producing day basis or 7.6 Bcf/d on a calendar day basis.

How Qilak LNG would fit in with ExxonMobil’s participation in Alaska’s other gas export project long on the table is uncertain. In a binding sales agreement last year with the state-backed Alaska Gasline Development Corp. (AGDC), ExxonMobil said it would sell its share of 30 Tcf from the Prudhoe Bay and Point Thomson units.

Also earlier this year the AGDC reached agreement with BP plc and ExxonMobil to collaborate on advancing Alaska LNG to improve competitiveness and secure FERC authorization. The agreement was considered a milestone for the BP and ExxonMobil affiliates, which along with ConocoPhillips relinquished control of Alaska LNG to the AGDC in 2016.

The trio of Alaska’s top producers three years ago determined that Alaska LNG was no longer economic when compared to other gas export projects around the world.

Alaska LNG, designed to export up to 20 mmty, is to include a three-train liquefaction plant in Southcentral Alaska at Nikiski, along with an 807-mile, 1.1 meter diameter pipeline. However, AGDC officials reportedly told state lawmakers earlier this year it could be dissolved if the project proved unfeasible. The Federal Energy Regulatory Commission is set to issue an environmental impact statement for Alaska LNG next March, with a final order in June.

Qilak LNG 1 is to be supported by Japan’s Bank for International Cooperation, which is working to fulfill a commitment to foster investment in U.S. LNG production capacity and bring supply to the Indo-Pacific region.

“The Qilak LNG 1 Project team will work closely with the North Slope Borough and other stakeholders to ensure that the development and subsequent operations are done in a safe and environmentally friendly manner,” said Qilak COO David Clarke, who formerly worked for BP. “We are committed to ensuring, through extensive scientific study and stakeholder engagement, that any impacts on marine mammals and subsistence activities are mitigated.”

A “significant portion” of the initial 4 mmty supply is dedicated to Dubai-based Lloyds Energy’s global downstream projects, Clarke said. In addition to export terminals, Lloyds Energy also works with offtake customers to design and build import terminals that offer floating storage and regasification facilities.

Qilak is “committed to working with Alaskan stakeholders to investigate economically viable distribution to local Alaskan markets via coastal delivery or tanker trucks,” Clarke said.

The announcement comes after a successful pre-feasibility effort, which examined the technical challenges of shipping directly from a facility offshore in the Beaufort Sea. Management concluded that with “available gas supply, competitive project economics, and a partner willing to utilize Alaska’s gas for power and city gas use in Asia, the Qilak LNG 1 project can be economically and technically viable.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |