Infrastructure | E&P | Marcellus | NGI All News Access | NGI The Weekly Gas Market Report

Spectra Steps Up for PSEG’s Stake in PennEast Pipeline

It didn’t take long for PSEG Power LLC to divest its minority stake in the PennEast Pipeline, as Spectra Energy Partners LP announced Monday that it has entered a purchase and sale agreement to increase its interest in the project.

Just one business day after New Jersey-based PSEG disclosed that it wanted to sell its stake to focus on the construction of three new combined cycle power plants and the rest of its generation fleet, Spectra agreed to acquire its 10% share. Enbridge Inc. completed its acquisition of Spectra Energy Corp. last month. The deal is subject to the approval of the PennEast board and other conditions, but if it closes in 2Q2017, Spectra would increase its investment in the nearly $1 billion project to 20%.

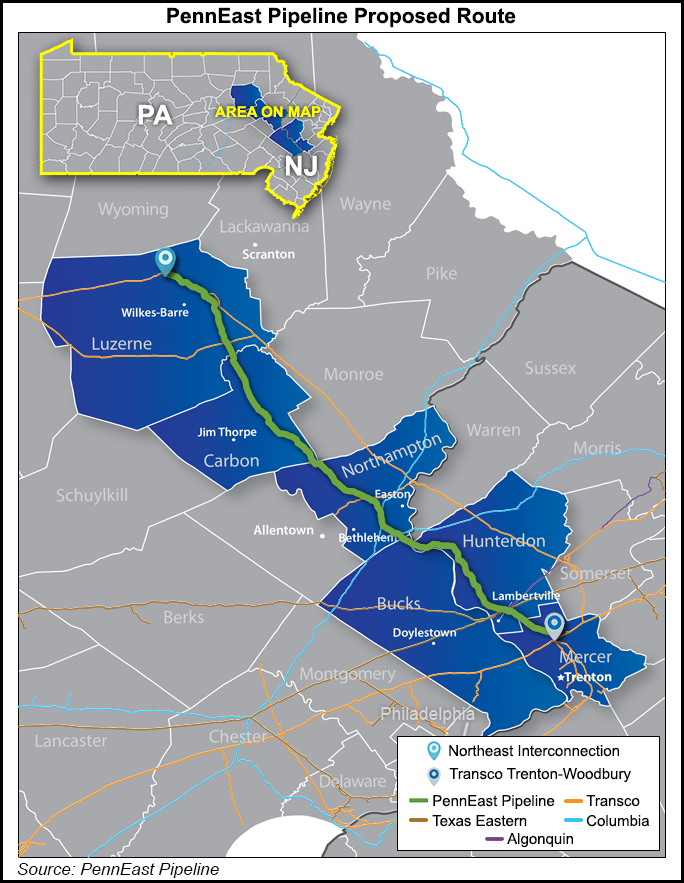

The 120-mile greenfield project would transport 1.11 million Dth/d of Marcellus Shale natural gas to markets in Pennsylvania and New Jersey. About 990,000 Dth/d of capacity has been secured, mostly by utilities. PSEG plans to remain a customer on the pipeline — its second largest with a 125,000 Dth/d commitment. New Jersey Natural Gas Co. is the project’s largest customer with a 180,000 Dth/d commitment.

Chairman of the PennEast board Dat Tran said PSEG’s commitment to the project underscores the need for more natural gas in New Jersey and responded to the pipeline’s critics by saying its decision to stay a customer “directly rebuts the notion this project is about excessive returns rather than a need for the gas.”

The other owners in the pipeline include AGL Resources Inc. unit Red Oak Enterprise Holdings Inc. (20%); NJR Pipeline Co. (20%); SJI Midstream LLC (20%), and UGI PennEast LLC (20%).

Earlier this year, the Federal Energy Regulatory Commission said it needed more time to consider additional environmental information and pushed back the project’s final environmental impact statement from Feb. 17 to April 7. PennEast said the project remains on schedule for an in-service date late next year.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |