Natural Gas Prices | LNG | LNG Insight | Markets | NGI All News Access

Southeast Natural Gas Forward Basis Sharply Higher Amid Rampant Cooling Demand

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |

E&P

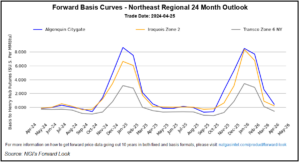

Supplies of natural gas in storage are stout everywhere, but East region inventories are closer to historical norms than any other section of the Lower 48. Should the densely populated Northeast sizzle amid scorching temperatures as forecast this summer, utilities in the heavy-gas consuming corner of the country could burn through more gas in the…

April 29, 2024By submitting my information, I agree to the Privacy Policy, Terms of Service and to receive offers and promotions from NGI.