Regulatory | E&P | NGI All News Access

Canada Fossil Fuels Exploration Expenses Projected to Decline, Impacting Federal Revenue

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |

LNG

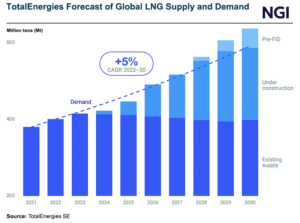

TotalEnergies SE said Friday that its LNG sales decreased in the first quarter mainly due to lower demand in Europe and an unplanned outage at the Freeport export terminal on the upper Texas coast. The company has 2.2 million tons (Mt) of annual tolling capacity at Freeport’s Train 3, which was offline most of the…

April 29, 2024Natural Gas Prices

Permian Basin

By submitting my information, I agree to the Privacy Policy, Terms of Service and to receive offers and promotions from NGI.