E&P | NGI All News Access | NGI The Weekly Gas Market Report

Lower 48 Explorers Denbury, Rosehill Each Seeking Chapter 11 Protection

Denbury Resources Inc. on Wednesday filed a prepackaged restructuring agreement ahead of a planned Chapter 11 filing, joining Rosehill Resources Inc. and Rosehill Operating Co. LLC, which on Monday sought protection.

Denbury, a Lower 48 carbon dioxide (CO) enhanced oil recovery (EOR) production specialist focused on the Gulf Coast and Rocky Mountains, is, like Rosehill, filing petitions in the U.S. Bankruptcy Court for the Southern District of Texas in Houston. The Plano, TX-based independent said it would continue to evaluate the operating environment and make adjustments, as necessary, to adapt to factors affecting its business.

“Denbury has developed a distinctive strategy focused on CO2 EOR, reinforced by a portfolio of high quality, low decline assets,” CEO Chris Kendall said. “Recently, our entire industry has been highly impacted by the global oil demand destruction caused by the Covid-19 pandemic, driving record low oil prices and rapid changes in energy market conditions.

“In response to this extraordinarily difficult business environment, we have taken multiple proactive steps at Denbury to preserve liquidity, including by reducing our capital spending and general and administrative costs and optimizing operations. This is in addition to many similar actions taken by the company over the last several years as we navigated significant oil price volatility and made consistent progress in reducing leverage.

“However, even after taking these steps, it became apparent that a comprehensive financial restructuring would be necessary to address our legacy debt burden and create a clear path forward for the company.”

Denbury undertook a “comprehensive review of alternatives,” Kendall said. “We are confident that this process will significantly reduce our debt, strengthen our balance sheet and position Denbury for a strong future. Looking forward, I believe that Denbury’s unique CO2 EOR focused strategy will continue to differentiate us from the industry, providing an advantageous solution that significantly reduces the CO2 emissions associated with the production of oil, underpinning our target of reaching full carbon neutrality in this decade.”

Kirkland & Ellis LLP is acting as legal counsel to Denbury, while Evercore Inc. is acting as financial adviser and Alvarez & Marsal is serving as restructuring adviser.

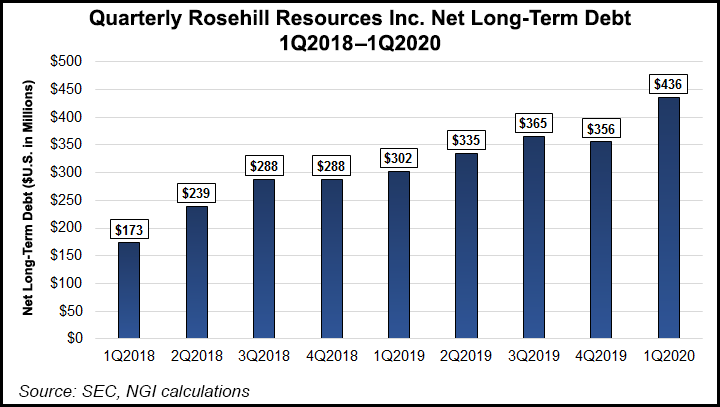

Meanwhile, Rosehill, which earlier this month completed a restructuring agreement with lenders, on Monday filed for Chapter 11 protection. The Permian Basin pure-play focuses on the Delaware sub-basin.

Like Denbury, Rosehill has a prepackaged restructuring support agreement in place with lenders that include Tema Oil and Gas Co., which holds 66.8% equity exploration business and 35.2% in the operating company.

All of the common equity is to be canceled with no recovery for shareholders, according to the prepackaged plan.

Rosehill has secured a $17.5 million debtor-in-possession loan facility to continue operating in the normal course of business. The company has notified Nasdaq that it intends to voluntarily delist its stock.

Gibson, Dunn & Crutcher LLP and Haynes and Boone LLP are representing Rosehill as legal counsel, while Jefferies LLC and Opportune LLP are acting as financial advisers.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |