Oil, Natural Gas Activity Across Louisiana, New Mexico and Texas Still Grim, Says Dallas Fed

Oil and natural gas activity has declined further in the second quarter across Louisiana, New Mexico and Texas, according to a survey by the Federal Reserve Bank of Dallas.

The Dallas Fed, as it is known, every quarter surveys energy executives across the Eleventh District, which encompasses northern Louisiana, most of New Mexico and Texas, which are home to the Permian Basin, Eagle Ford and Haynesville shales.

The latest data was compiled from June 10-18, with 168 energy firms responding, including 115 exploration and production (E&P) firms and 53 oilfield services (OFS) companies. Covid-19 lockdowns have rocked the energy world, as oil and gas demand has plummeted and thousands of jobs have been lost. Executives offered few positives in their responses.

“This downturn will weed out a lot of shale players who were effective ‘money changers’ who took willing investors and Wall Street for a ‘churning’ experience in shale over the last five years or so,” one E&P executive said. “Hopefully, real money might begin to look at real projects that make a real return on investment as we move forward. I am much less optimistic looking forward because of the extreme mismanagement by the Republicans in Washington.”

Another E&P executive said “the oil industry went into a deep hole in the first quarter 2020. We reached the bottom, and now we are trying to climb up. It will be quite a while (2022-plus) to get back up the hole to the pre-Covid-19 level of activity and service pricing.”

No Quick Recovery

Only 54% of the E&P executives surveyed expect global oil consumption to return to pre-pandemic levels “sometime in 2021,” with 3Q2021 “the most picked quarter” at 18%. Thirty-six percent don’t expect a return until 2022 or later, while 5% don’t foresee a return to prior levels at all. Only 5% expect a return to activity levels before the pandemic later this year.

“On a cumulative basis, 59% of executives expect global oil consumption to return to pre-Covid-19 levels by the end of 2021, and 95% of respondents expect it to return sometime by 2022 or later,” researchers said.

Forty-one percent of executives surveyed don’t expect U.S. drilling and completion activity to return to pre-pandemic levels until “sometime” in 2021, with 39% not forecasting a return before 2022 “or later,” and 16% don’t foresee any return to prior levels.

Still, most executives are confident in the future of their firms, with 95% expecting to remain solvent for the next year and 5% anticipating becoming insolvent.

“We expect to remain solvent for the next year; however, if commodity prices do not recover or decline again, all bets are off,” said one OFS executive.

Questioned about whether they have shut-in any production during 2Q2020, 82% of the E&P executives said they had, and 71% of them were still curtailing oil this month.

“Of the firms that shut-in or curtailed production, the majority of executives — 94% — cited low wellhead prices as the primary reason driving that decision,” researchers said. “Four percent of executives cited pipeline or refinery operators refusing to accept crude oil, and 1% noted that storage was unavailable.”

As to when most of the shut-in volumes would be restarted, 36% said they expected to restart output by the end of the month, with 20% more likely to bring wells online in July. Another 18% said August was the likely restart period. However, 14% were hesitating until September, and the remainder did not look to restart volumes until November “or later.”

Queried about what oil price it would take for most E&Ps to ramp up shut-in wells, 30% predicted averages between $36/bbl and $40, while 27% said $41-45. Another 19% predicted an oil price under $36, while 24% said “at or above” $46.

Some energy firms have sought federal assistance since the pandemic began, including 10% seeking Small Business Administration Economic Injury Disaster Loans. However, 47% had not applied for any assistance, the survey found.

$2.15 Henry Hub Forecast

Although business conditions deteriorated, executives were more optimistic about the outlook for Henry Hub natural gas prices by year’s end, with an average forecast of $2.15/MMBtu. For reference, Henry spot prices averaged $1.61 during the survey collection period. West Texas Intermediate (WTI) oil is expected to average $42.11 by the end of the year. WTI was averaging $37.75 during the survey period.

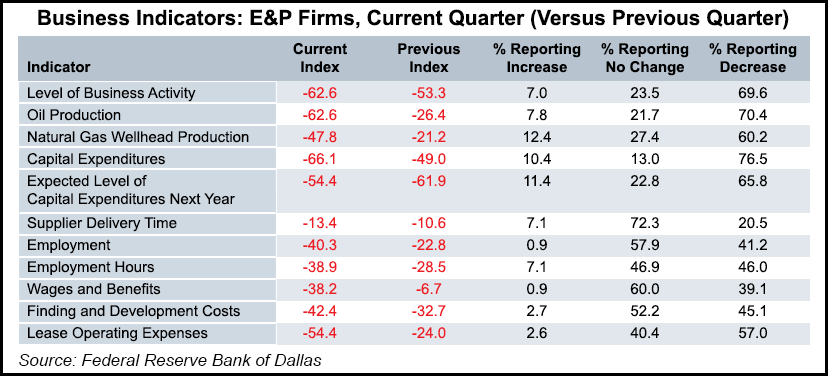

The second quarter business activity index, considered the broadest measure of conditions facing firms, fell sequentially to minus 66.1 from minus 50.9. The OFS index plunged to minus 73.5 from minus 46.3, while the E&P index declined to minus 62.6 from minus 53.3.

The oil production index fell 36 points to minus 62.6, while the natural gas production index was down at minus 47.8 from minus 21.2.

The index for E&P capital expenditures (capex) slumped from 1Q2020 to minus 66.1 from minus 49.0, while the OFS capex declined to minus 73.5 from minus 50.0.

“Most indexes point to worsening conditions” for OFS firms, which rely on their E&P customers for work. The equipment utilization index fell to a survey low from the first quarter to minus 69.2 from 47.2, while operating margins declined to minus 68.6 from 50.0.

“While firms found relief as input costs collapsed, as that index fell from minus 11.3 to minus 50.0, the index of prices received for services also slid further into negative territory, from minus 37.7 to minus 64.7,” researchers said.

The aggregate employment index posted a fifth consecutive negative reading, declining to minus 46.1 from minus 24.0, “which suggests an acceleration in job cuts.” In tandem, the aggregate employee hours worked index dropped to minus 47.0 from minus 32.1, while aggregate wages/benefits fell further into negative territory, to minus 41.7 from minus 8.2.

“The company outlook index reading improved but remained deeply negative at minus 51.0 in the second quarter, indicating outlooks deteriorated,” said researchers. “While uncertainty remained elevated, slightly fewer firms noted rising uncertainty this quarter than last, and the aggregate index fell 28 points to 35.7.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |