Pemex Must Reactivate Farmouts To Meet Production Goals, BBVA Says

Mexico’s state oil company, Petróleos Mexicanos (Pemex), will need help from the private sector to make the government’s oil and gas production targets a reality, according to a new report by BBVA México.

“To increase the chances of significantly growing production in the final three years” of president Andrés Manuel López Obrador’s six-year term, “we suggest the reactivation of the business model based on farmouts,” the bank said in its Situación México 3T19 (Mexico Situation 3Q19) report.

“This way, Pemex could share not only the exploratory risk, but also the investment and technological know-how of other leading companies in the oil industry.”

López Obrador, who took office last December, has set a crude oil output target for Pemex of 2.4 million b/d by 2024, the final year of his term, up from 1.67 million b/d currently. Pemex’s recently released business plan sets a natural gas production goal of 4.916 Bcf/d for 2024, from an expected average of 3.561 Bcf/d this year.

However, the government has suspended bid rounds and farmout tenders for operating interests in Pemex blocks, a direct departure from the strategy of the previous administration.

Through Pemex’s inaugural farmout tender in 2016, Australia’s BHP snapped up an operating stake in the Trion deepwater field in the Perdido fold belt.

In a subsequent 2017 tender, Germany’s DEA Deutsche Erdoel AG (now Wintershall Dea GmbH) and Egypt’s Cheiron Holdings Ltd. became operators of the Ogarrio and Cardenas-Mora fields, respectively.

In July of this year, BHP spudded a second appraisal well at Trion, where the company expects production could begin by the mid 2020s.

In March, CNH approved development plans for Ogarrio and Cardenas-Mora that entail combined investment of more than $1.4 billion.

Pemex needs annual investment of around $20 billion to meet the government’s production goals, Spanish news agency Efe quoted BBVA México chief economist Carlos Serrano as saying.

The only way to do this, he said, “is attracting private capital because there isn’t fiscal space in Mexico for the government to provide these resources.”

Pemex’s 2019-2023 business plan, meanwhile, does not sufficiently address the firm’s underlying problems, the report said.

“While the business plan includes some measures to strengthen both the finances and productive capacity of Pemex, we believe they are insufficient to resolve the two large structural problems that face the company: excessive financial debt and the fall in production.”

Pemex’s financial debt stood at $104.4 billion as of June 30. Production of crude oil and condensates fell 10.2% year-on-year to average 1.85 million b/d during the second quarter.

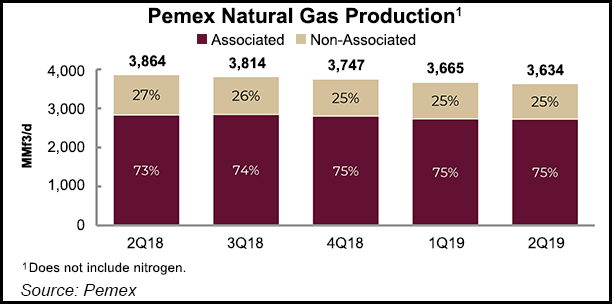

Natural gas production from Pemex fields dropped 6% to average 3.864 Bcf/d, while dry gas output from its processing facilities dipped 9.5% to 2.451 Bcf/d.

The business plan includes a series of measures to reduce Pemex’s fiscal burden, which Pemex says is “the most grave structural problem” that it faces.

“The permanent reduction of Pemex’s fiscal burden and the capital injections to Pemex beyond 2022 should be accompanied by modifications to the tax collection policy that don’t put at risk the fulfillment of fiscal goals,” BBVA said. “Such an action would mitigate the risk of a downgrade in the sovereign credit rating in the short and medium-term.”

BBVA said it is maintaining its projection for Mexico’s economy to grow by 0.7% in 2019, and 1.8% in 2020, due to factors including a global economic slowdown and uncertainty over domestic policy in Mexico.

Warning that “the government still must address Pemex’s problems in a credible manner,” the report said that Pemex is one of the main risk factors for a weakened Mexican peso.

Other risk factors for the currency include delays to the signing of the United States-Mexico-Canada Agreement (USMCA) and trade tensions between the United States and China.

In related news, CNH on Wednesday approved a $330.5 million development plan submitted by Pemex Exploración y Producción (PEP), Pemex’s upstream unit, for the Octli onshore field.

Octli is one of 20 onshore and shallow water fields for which Pemex is accelerating development, in order to reverse its declining production.

Pemex aims to extract 24.77 million bbl of oil and 31.31 Bcf of natural gas by the end of the project’s economic life in 2036.

Octli is the 10th of 20 fields for which Pemex has obtained development approval from the regulator.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 |