NGI The Weekly Gas Market Report | E&P | NGI All News Access

Mexico Cancels Pemex Farmout Tender to Dismay of Reform Advocates

Mexican upstream hydrocarbons regulator Comisión Nacional de Hidrocarburos (CNH) last week formally canceled a tender for operating stakes in seven onshore areas currently held by national oil company Petróleos Mexicanos (Pemex) in the states of Veracruz, Tabasco and Chiapas.

The farmout tender would have been the sixth conducted under the framework of Mexico’s 2013 constitutional energy reform, which has sought to attract private capital to the energy sector to ease the investment burden on Pemex and state power utility Comisión Federal de Electricidad (CFE).

The areas on offer for the planned tender contained a combined 392 million boe of proved, probable and possible, or 3P, hydrocarbon reserves and 683 million boe of unrisked prospective resources as of June 2018, and were producing 43,000 b/d of crude oil and 228 MMcf/d of natural gas, according to Pemex.

Although CNH technically canceled the tender, it did so at the behest of energy ministry Sener, which withdrew the seven areas from consideration for bidding, CNH commissioner Sergio Pimentel said during last Thursday’s session.

President Andrés Manuel López Obrador has long opposed the energy reform and its mechanisms for attracting private sector investment, which include the farmout tenders for acreage already assigned to Pemex, as well as bid rounds for new blocks.

Last December, shortly after López Obrador took office, his administration canceled onshore bid rounds 3.2 and 3.3, which were scheduled for February, and postponed the farmout tender from February to October.

That the farmout tender was merely postponed instead of canceled gave reform advocates a glimmer of hope that the new regime would still allow debt-laden Pemex to form upstream partnerships with international operators, improving Mexico’s chances of reversing a 15-year slide in oil production.

That hope was extinguished by the tender’s cancellation, which came only days after Fitch Ratings had downgraded Pemex bonds to junk status, citing unpredictable energy policy and lack of a coherent plan for Pemex from the López Obrador administration.

The termination of the farmout tender “cancels the possibility of Pemex receiving fresh [capital] resources from the private sector,” said Pimentel.

López Obrador has set a crude oil production target of 2.4 million b/d for Pemex by 2024, up from 1.675 million b/d in April.

“There is no way to achieve the production goal that the federal government has set…without the support of the private sector,” Pimentel said.

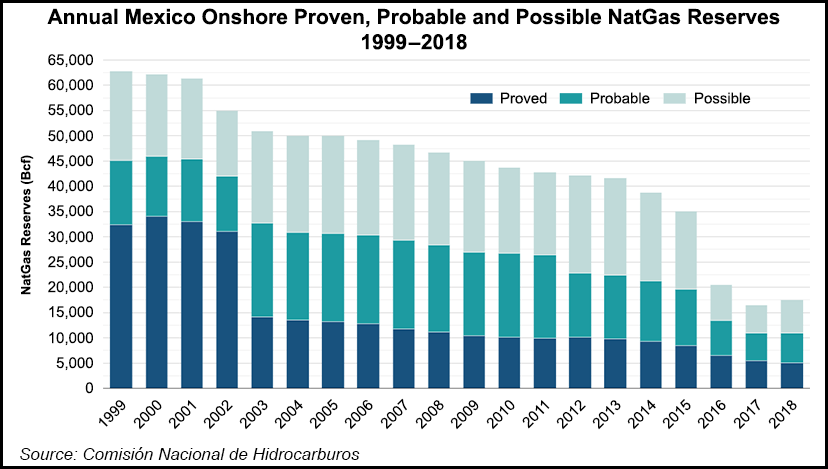

In a research note last month, Talanza Energy Consulting founder Marco Cota called farmouts “the best and only solution to increase Pemex’s execution capabilities.” He said although Pemex was awarded 83% of Mexico’s proved plus probable, or 2P, reserves through CNH’s Round Zero process in 2014, the state oil company had only fulfilled 36 of 101 work commitments at its Round Zero acreage as of end-2018, and that only 27% of the allocated areas recorded any activity at all from 2015-2017.

“After five years…it is clear that Round Zero was too much for Pemex to handle,” Cota said.

Three of the five farmout tenders conducted previously resulted in the signing of joint venture contracts between Pemex and private sector operators. These pertain to the Trion, Cardenas-Mora, and Ogarrio fields.

Australia’s BHP secured a 60% stake in the deepwater Trion field by offering a 4% additional royalty and a $624 million tiebreaker lump sum to Pemex in 2016. Trion was the site of the first-ever discovery on the Mexican side of the Perdido fold belt in the Gulf of Mexico. CNH in May approved a planned second appraisal well at Trion, which BHP plans to spud in the second half of 2019.

In March, CNH approved development plans entailing combined investment of $1.44 billion through 2043 for the Cardenas-Mora and Ogarrio onshore fields in Tabasco, which are operated by subsidiaries of Egypt-based Cheiron Petroleum Corp. and Germany’s DEA Deutsche Erdoel AG, respectively.

Also last week CNH approved four offshore development plans submitted by a subsidiary of Royal Dutch Shell plc, entailing combined investment of up to $1 billion. Of the four projects, three are in the Cuenca Salina Basin on the southeastern coast, with the fourth pertaining to the Perdido in the deepwater.

The acreage was awarded in the Round 2.4 bidding process conducted in early 2018, which saw the awarding of nine blocks to Shell. All nine have now been approved.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 | ISSN © 1532-1266 |