E&P | NGI All News Access | NGI The Weekly Gas Market Report | Regulatory

BP’s Lower 48 Delivers but LNG Oversupply, Prices Seen Under Pressure Through 2021

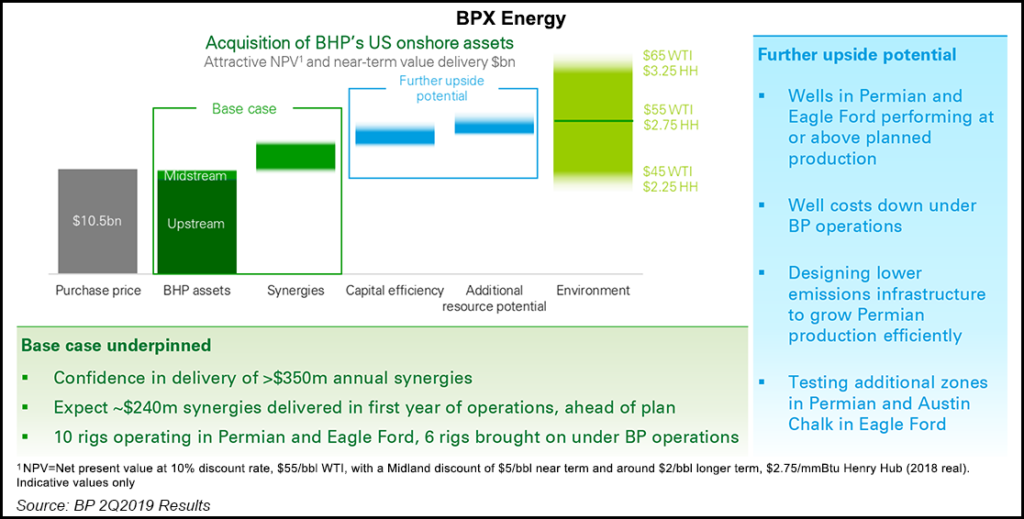

BP plc reported better-than-expected results in the second quarter, in part on a strong showing in the Lower 48, with synergies from the BHP onshore acquisition ensuring a strengthening U.S. business, executives said Tuesday.

Upstream chief Bernard Looney, who oversees the Lower 48 business BPX Energy, shared a microphone with CEO Bob Dudley and CFO Brian Gilvary to discuss the latest quarter and outlook for the year.

Integrating the $10 billion bundle of BHP assets acquired last year has been above expectations, Looney said.

“We are now very confident in delivering over $350 million of annual synergies by 2021,” he said. “At the time of the transaction, we had expected to achieve about $90 million of this in 2019. But now expect to achieve around $240 million or 70%, the full run rate. The majority of this has been made through organizational efficiencies designing the combined organization for scale and enabling us to grow with less overhead.

“We also continue to ramp-up activity in the newly acquired assets with 10 rigs operating — seven in the Eagle Ford and three in the Permian. The early results from our operations have been promising in both basins. The wells we have drilled are performing at or above their planned production levels and costs for new wells are coming down.”

BP also is working to optimize field development in the Permian.

“We’re designing infrastructure that will improve reliability and reduce cost, and help us minimize emissions. We plan to continue testing promising new zones this year in the Permian, and the Austin Chalk in the Eagle Ford,” Looney said. “The progress to date and capturing the synergies early, and the well results continues to give us confidence in the future of the business.”

BP in the quarter ran a total of 13 rigs in the Lower 48, including six in the Eagle Ford Shale, a play where it had no activity a year ago but a big BHP activity center. BP also had three rigs running in the Permian, another play where there were no BP-operated rigs in 2Q2018. In addition, BP was running four rigs in the gassy Haynesville Shale, down by two year/year.

The U.S. onshore growth was tied in part to higher oil production combined with stronger West Texas Intermediate (WTI) prices versus the first three months of the year.

“We will look to make sure that we can evacuate all that we start to create out of the Permian, so we have got the rigs running,” Dudley said. “We will build into that slowly.

“We’ve ramped up in the Eagle Ford, which is priced straight into WTI, but in terms of Permian, it will be slow progress through this year as we make sure that the evacuation routes are available.

“The midstream is going to be a really big, important part of that…It’s going to be a big function of what happens of course, in the second half of this year in terms of production volumes.”

However, natural gas prices continue to slump, which Dudley blamed on lower demand and a global oversupply of liquefied natural gas (LNG).

“In the gas markets, an easing in demand growth following the exceptional strength seen last year and continued expansion of LNG supply has led to significantly lower prices,” Dudley said. “The Henry Hub gas price remains well below $3.00/MMBtu. And spot prices in Europe and Asia are about 40% below their levels a year ago.

“In the absence of extreme weather conditions, LNG is expected to be over-supplied through 2019 and 2020 with gas prices expected to remain under pressure.”

Prices likely will “remain volatile,” Gilvary said. “Recent geopolitical events…and the potential for worsening global economic conditions, are creating concerns around supply and demand fundamentals, driving volatility in prices.” U.S. gas prices also “remained weak during the second quarter, with Henry Hub averaging $2.60/MMBtu compared with $3.20 in the first quarter.

“The weakness in price reflects continued strong supply growth and inventory levels increasing relative to the low levels of the previous two quarters in Europe, and Asia spot prices have reduced significantly as LNG supply continues to grow with demand easing, particularly in China.”

BP’s “macro view of the environment sits alongside the big energy system change that is underway as society looks to move toward a more sustainable low carbon future,” Dudley said. He spent considerable time discussing BP’s “energy transition” as it captures more low-carbon assets and expands its alternative energies division.

“In a world that is not currently on a sustainable path, we are actively supportive of advancing a faster transition,” the CEO told investors. “As well as being in the world’s best interests, we believe it is in the best interest of BP and all its stakeholders. It means less uncertainty, and planning our business and greater clarity about how we can help meet society’s needs for more energy with lower greenhouse gas emissions, with good returns for our shareholders.”

Across the company, “our ”reduce, improve, create’ framework, focuses the Group as a whole of reducing emissions in our operations, improving the quality of our products so that our customers can reduce their emissions and on creating new low or zero carbon businesses.”

BP also is continuing to advocate “for well designed policy measures, including putting a price on carbon for producers and consumers, which only governments can do,” Dudley said. “We believe this is the most efficient and equitable tool to drive changes in behaviors across the entire energy system.”

BP will not wait on government dictates, but rather frame the company’s future by “actively growing our low carbon activities…Unlike what some of our critics may say, we believe we have a significant role to play, and can be part of the solution.”

Asked if there was “disproportionate pressure on BP” as Dudley often defends the company’s “climate consciousness,” the CEO said he did think there was more pressure on the London-based supermajor than others in the industry. “I think it feels a little bit that way…London is becoming sort of the epicenter for climate demonstrations, and this is our hometown, so I think we are clearly singled out in that. I think we’re happy to engage.

“We don’t mind demonstrations. We want to talk with people; we need to talk to people that also want to have dialogue. I do think this demonization and polarization of companies and people is not going to help solve what is a really difficult problem. We’re not going to shy away from that…

“I’m a big one to say it’s not what you say it’s what you do, and I keep looking at what we do…

“But I do urge everyone who takes a very single view of the world that ”there should be no natural gas. It should be only renewable energy.’ That’s not really helping the debate, so we’re going to contribute to the debate and…we have pretty thick skins…Even though we get a lot of pressure, we’ve also got to maintain the fact that we have to be an investable proposition for you all.”

Underlying replacement cost profit, which roughly translates to the U.S. net earnings, was $2.81 billion ($13.82/share) in 2Q2019, nearly flat from a year ago when the company earned $2.82 billion ($14.14), but up from $2.36 billion ($11.69) in 1Q2019. Operating cash flow, excluding the Gulf of Mexico oil spill payments related to the 2010 Macondo incident, was $8.2 billion.

Production for the second quarter climbed 6.5% year/year to 2.625 million boe/d.

In the third quarter, BP expects upstream production to be lower sequentially because of seasonal turnaround and maintenance activities, including in the Gulf of Mexico (GOM), North Sea and Angola. The caution also relates to potential weather impacts in the GOM, where BP had 14 days of disruption associated with Hurricane Barry, Gilvary noted.

Organic capital expenditures for 2019 remain in the range of $15 billion to $17 billion, and gearing is forecast to trend down through the second half of the year into the 27% range.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |