Markets | LNG | LNG Insight | NGI All News Access | NGI The Weekly Gas Market Report

LNG Surplus to Spur European Coal Switching but Mild Winter May Slam Global Prices

Global natural gas prices have fallen enough to absorb the current glut and cause the European Union’s power sector to switch from coal, but a mild winter or worsening macro could lead to severe price issues across the board, according to BofA Merrill Lynch Global Research.

Commodity strategists in a note said the liquefied natural gas (LNG) surplus could drive 2020 prices lower, leading to a repeat of coal-to-gas switching. However, as global gas is “more connected than ever,” the weather could play a big role.

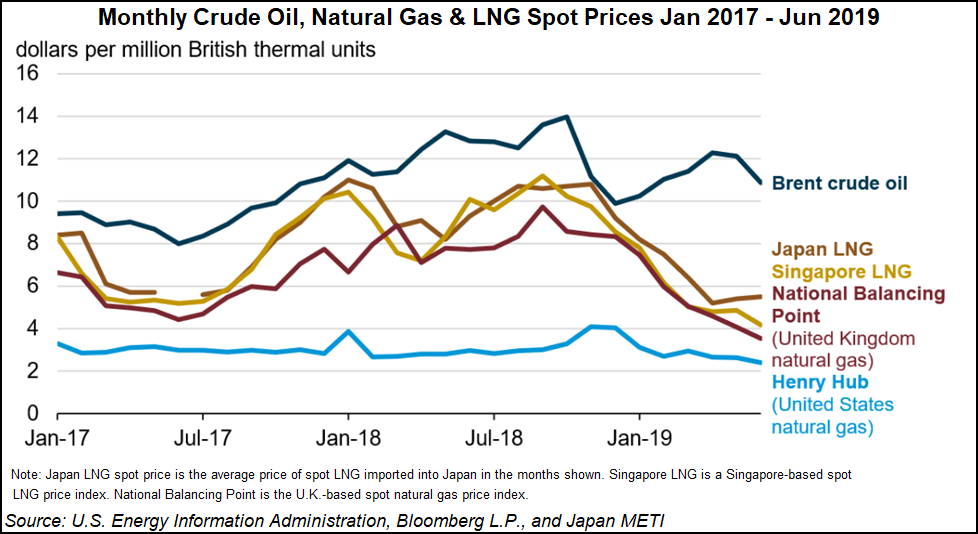

“Earlier this year, we were concerned that Europe would be called on to balance the global gas market as the onslaught of U.S-led LNG supply would be too much for Asian consumers to digest,” the analyst team said Thursday. “Sure enough, European LNG imports increased significantly this year, which caused European natural gas prices to collapse to $4.10/MMbtu on average this summer.

“We estimate these prices were $1.5-2.0/MMbtu cheaper than coal, causing European utilities to switch from coal to gas and balance the global gas market.” European storage Injections this summer decreased year/year as increasing power generation offset the rise in imports. However, European gas stocks today are at record high levels.

“If the global gas market exhausts European storage capacity in the coming weeks, relatively low LNG shipping rates could facilitate floating storage to help balance the market until cold weather shows up,” analysts said.

China’s average gas imports are expected to be 62 million metric tons/year (mmty), only 14% higher than in 2018 and below historical growth rates. The bank’s equity analysts recently reduced estimates for China gas demand in 2019-2021 because of the prolonged U.S. trade war.

“We believe the slower rate of demand growth, rising domestic production and new pipelines will limit China LNG import growth,” analysts said. Other “major Asian importers” also have realized weaker gas demand this year. In aggregate, analysts expect Asian LNG demand growth of 15 mmty and global growth of only 8 mmty year/year in 2020, “and the weakening macro outlook presents downside risk to our forecast.”

The United States should continue to lead global growth, ramping up around 40 mmty over the next two years, while Europe plays the balancing marketing through coal-to-gas switching until demand catches up.

“Unfortunately, due to the steep contango in the European natural gas curve, coal prices are much more competitively priced for 2020,” analysts said. “Therefore, we expect some, if not most, of the coal-to-gas switching that occurred this year to reverse in 2020 based on forward prices.”

BofA now expects to see an estimated 2.1 mmt/month of gas oversupply in 2020 — 23% larger than an estimate earlier this year.

“Absent a complete breakdown in Russia and Ukraine pipeline negotiations, we believe global gas is priced at least $1/MMBtu too high next year relative to coal. If the European power sector cannot handle what we estimate to be a larger problem next year, U.S. LNG export economics and U.S. Midwest coal-to-gas switching could come into play.”

That said, a “mild winter across the northern hemisphere or a worsening macro backdrop could be catastrophic for gas in all regions.”

The U.S. Energy Information Administration in its International Energy Outlook 2019 (IEO2019) released last Tuesday, said gas and petroleum consumption was rising in Asia faster than supply was growing, which could shift trade patterns and infrastructure investments. Global energy consumption, led by Asian countries that are not part of the Organization for Economic Cooperation and Development, are expected to increase by nearly 50% between 2018 and 2050.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |