Markets | Natural Gas Prices | NGI All News Access | Shale Daily

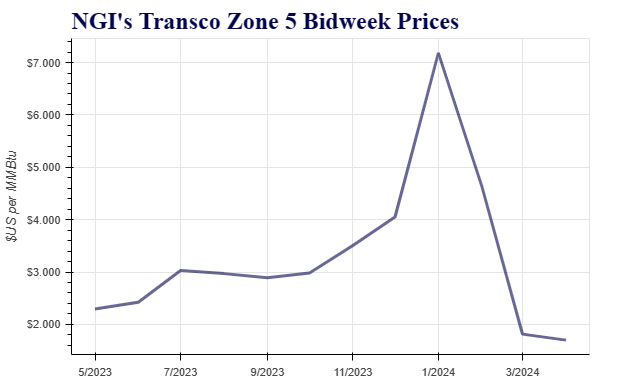

May Natural Gas Bidweek Prices Depressed on Second Day of Trade

Earnings

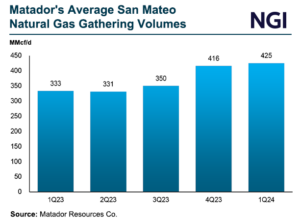

Matador Bullish Even on Weak Waha Prices, as NGLs Diversifying Delivery Options

Dallas-based independent Matador Resources Co. delivered better-than-expected results during the first quarter, with Permian Basin-heavy natural gas production jumping 36%. Gas output reached nearly 390 MMcf/d, 4% higher than guidance. That came even as average realized gas prices were $2.96/Mcf, about 25% lower year/year. What stoked the performance was the diversified portfolio, executives explained during…

April 26, 2024Haynesville Shale

Plunging Haynesville Production Leads Overall Natural Gas Supply Cut; Price Response Muted

April 26, 2024By submitting my information, I agree to the Privacy Policy, Terms of Service and to receive offers and promotions from NGI.