NGI Archives | NGI All News Access

Shale Gas, Oil Walk Price, Regulatory Tightrope, S&P Says

The U.S. shale revolution and the abundance of cheap natural gas, natural gas liquids (NGL) and oil it provides are drawing industries back to the country. That is expected to continue, but there are risks to the growth story, analysts at Standard & Poor’s Ratings Services (S&P) said in a recent note. Commodity prices and the potential for further regulation are the main things to watch.

“It’s striking how much industrial development the [shale] revolution has spurred in the U.S.,” said S&P’s John Kingston. “Industries that had left the country a long time ago are returning. I think of direct reduced iron, a steel-making feedstock [see Daily GPI, Nov. 8]. A couple of plants are back in the U.S. There’s also a big pipe and tube plant in Youngstown, OH [see Shale Daily, Jan. 12, 2012], to serve the Marcellus Shale.

“And Dow Chemical Co. has announced that it is making some big chemical expansions [see Daily GPI, March 19]. None of this would have happened without the natural gas price advantage that the U.S. has over its international competition.”

But in the same note Kingston and some of his colleagues weighed in on issues that could retard the progress of shale development. Local opposition to drilling activities and related, particularly hydraulic fracturing (fracking), and tighter regulation, are potential threats to the industry said S&P analyst Carin Dehne-Kiley. She cited New York State, which has banned fracking, as an example.

“Although we don’t think other states will follow suit, tighter regulation could ultimately increase costs for shale development,” she said.

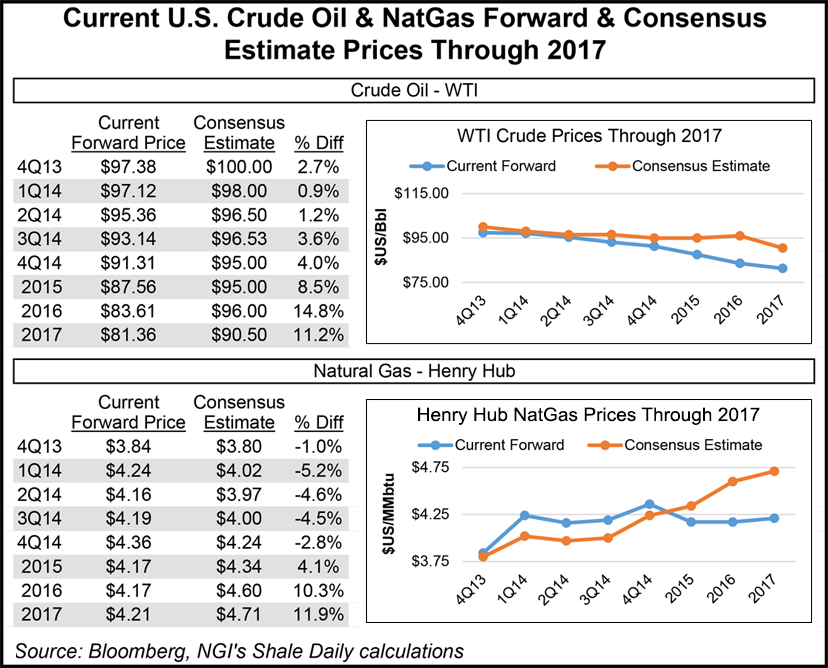

However, according to Dehne-Kiley, the biggest risk to continued shale development is commodity prices. Oil prices need to be $50-60/bbl for shale development to break even, she said. “On the gas side, though, we think it takes about $4 to $5 per Mcf to make development of gas shale economical, compared with the current price at about $3.70 to $4 per Mcf.”

But the attractiveness of natural gas in an increasingly emissions-conscious environment provides support for natural gas prices.

“…[I]t’s no coincidence that we’re seeing a significant increase in emission regulation just as gas prices have plummeted,” said S&P analyst Jeff Panger. “An abundance of cheap natural gas from shale gives utilities an alternative to coal-fired generation in an era of increasing regulation…Utilities that build new generation are putting in combined-cycle units because of lower commodity and capital costs, faster construction, easier permitting and lower carbon footprints. Now if additional environmental regulations come out, as we expect, we’ll likely see an even greater flight to natural gas as a fuel of choice for power generation.”

At about $5/Mcf gas, there is “general equilibrium” between natural gas and coal when it comes to power generation, Panger said. Prices above $6/Mcf are out of the money for power generation.

“The biggest wildcard is regulation,” Panger said. “Increasing emission regulation could prompt greater fuel-switching but at the same time make the electric industry’s demand for natural gas more price-elastic. Meanwhile, there’s the potential for increasing regulation of fracking, which could compromise supplies, putting upward pressure on prices and lowering demand for the commodity.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |