Infrastructure | NGI All News Access

Mexico’s CFEi Seeking Physical Natural Gas Supply into Trans-Pecos Header

The international fuel marketing affiliate of Mexican state power company Comision Federal de Electricidad (CFE) is seeking supply of up to 1.15 Bcf/d of natural gas into a pipeline system that connects with transmission networks across the border in Chihuahua state.

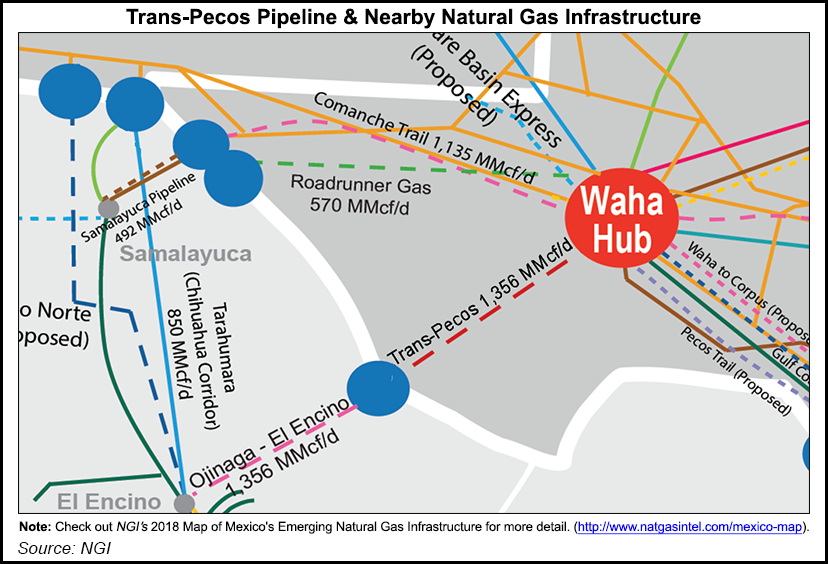

CFE International LLC (CFEi) earlier this month issued a request for offers (RFO) for long-term physical supply of gas into the Trans-Pecos Pipeline LLC header system in the Waha region of West Texas. The supply offers must be for a minimum of three years and commence delivery no later than Nov. 1.

“CFEi seeks offers for the supply of natural gas to be used to meet fuel requirements for CFE’s generation and other downstream load, [for] which total demand is approximately 2.4 Bcf/d,” according to a copy of the RFO republished Tuesday.

The company is “particularly interested in offers for that long term supply (and swing supply, as applicable) associated with infrastructure connecting natural gas production areas to CFEi’s network of pipeline capacity in western Texas.”

The baseload supply sought in the RFO would ramp up over three years, starting at 130-150 MMcf/d in 4Q2018, reaching 600-900 MMcf/d by 2Q2019 and topping out at 950 MMcf/d to 1.15 Bcf/d in 1Q2020 through 3Q2021.

Interested bidders may submit questions electronically to waha.services@cfeinternational.com until July 26. CFEi expects to meet with bidders in Houston on Aug. 6, while final offers are due the following week.

“CFEi reserves the right to reject any and/or all offers and not to award any contracts or enter any definitive agreements based on this request for offers, without liability to any party,” the company said.

Bidders may submit proposals to deliver physical natural gas via pipeline from any natural gas production area in the United States into any new or existing interconnection delivery point on CFEi’s West Texas transportation capacity network, including but not limited to the Comanche Trail pipeline and the Trans-Pecos pipeline, according to the document.

These delivery points may include one or more of eight interconnects with the Trans-Pecos Waha header, as listed in the RFO.

The header system, as well as Trans-Pecos and Comanche Trail, all came online last year. The three projects are owned by affiliates of Energy Transfer Partners LP (ETP), Carso Energy Corp. and MasTec Inc., and are anchored by long-term agreements with CFE to transport gas from the Waha Hub in Pecos County, TX, to the Texas-Mexico border.

The US-based CFEi, along with its Mexican counterpart CFEnergia, was created after Mexico’s 2013-2014 energy reform to market natural gas and other fuels on behalf of the state power company. The two affiliate companies also manage the capacity rights that the utility holds for pipelines on both sides of the US-Mexico border.

CFE’s power plants and the privately owned independent power producers under contract with the state company are among the leading consumers of natural gas in Mexico.

Delays to downstream pipelines in Mexico have constrained flows at Trans-Pecos and Comanche Trail, as well as other cross-border pipelines connected to the Permian Basin. Mexico is one of three primary offtakers for Permian gas, along with the domestic U.S. and global liquefied natural gas markets.

However, this week TransCanada Corp. confirmed the start-up of the 670 MMcf/d El Encino-Topolobampo pipeline, completing the final link in a system that extends to Mazatlan, Sinaloa, on the Pacific Coast. The Encino-Mazatlan system receives gas indirectly from several pipelines on the West Texas border, including Comanche Trail.

Additional pipelines in central Mexico are also expected to come online later this year, which would open up additional downstream routes for Permian supply.

The 2.6 Bcf/d Sur de Texas-Tuxpan marine pipeline is also scheduled to go into service later this year in the northeast, which is where most U.S. gas exports currently flow into Mexico.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 |