Infrastructure | NGI All News Access | NGI The Weekly Gas Market Report

Mexico’s CFE Sees Growth Opportunity in Natural Gas, Pipeline Capacity Marketing

Mexico’s Comision Federal de Electricidad (CFE) this year is looking to maximize the value of its pipeline contracts and consolidate its position in the country’s fledgling natural gas market.

The state-owned power utility released its 2018-2022 business plan last week. For CFE’s emerging natural gas business, this year’s priorities include ensuring that the pipeline projects under tender are completed on time and marketing its excess transport capacity to third parties.

“The marketing business will be a growth vector for CFE,” according to the document. “In particular, the marketing area with the most potential for growth is the capacity on our natural gas pipelines.”

CRE has spearheaded a historic buildout of Mexico’s natural gas pipeline network. Since 2012, it has tendered various projects in the northwest and central regions, as well as the 2.6 Bcf/d Sur de Texas-Tuxpan marine pipeline along the northeast coast.

The utility is the anchor customer for these projects, whose principal developers include local firm Fermaca, TransCanada Corp. and Infraestructura Energetica Nova (IEnova), the Mexico unit of Sempra Energy. The new pipelines, which are privately owned, are to transport gas from the U.S. border down into Mexico to supply CFE’s fleet of power plants, expected to be among the main drivers of domestic gas demand over the coming years.

Several of the pipelines are facing right-of-way disputes and social protests that threaten to put them behind schedule. As of November, 2,886km of the CFE-sponsored pipelines were in service and an additional 4,495km under construction, according to the business plan. The company expects the remaining projects to come in service by the end of this year.

The task of “commercializing” the capacity reserved on these pipelines falls to CFEnergia, one of the two fuel marketing affiliates created by CFE after the 2013-2014 energy reforms.

“CFE assigned all of the transport capacity it has contracted long-term to CFEnergia,” Guillermo Turrent told NGI’s Mexico GPI. He is CEO of CFEnergia and CFEi, the other affiliate company, which focuses on international fuel marketing.

In addition to the new private pipelines, CFE also holds capacity on Mexico’s largest pipeline network, the Sistrangas, which is operated by the state-owned Centro de Control del Gas Natural (Cenagas). All capacity contracts on the 6.4 Bcf/d Sistrangas system are up for renewal this year.

“One of the tools that CFEnergia will use to fulfill its mandate [to optimize CFE’s pipeline capacity] is the organized auctions that Cenagas imposes and/or the electronic bulletin boards of individual transporters,” Turrent said. But “I think that what CFEnergia will use the most will be its own electronic trading platform starting in April 2018.”

CFEnergia has been working on developing the online trading platform, tentatively called CFEonline, for more than a year, executives said at a conference in January. The platform is to include monthly and day-ahead pricing and is expected to take at least six months to mature after it launches.

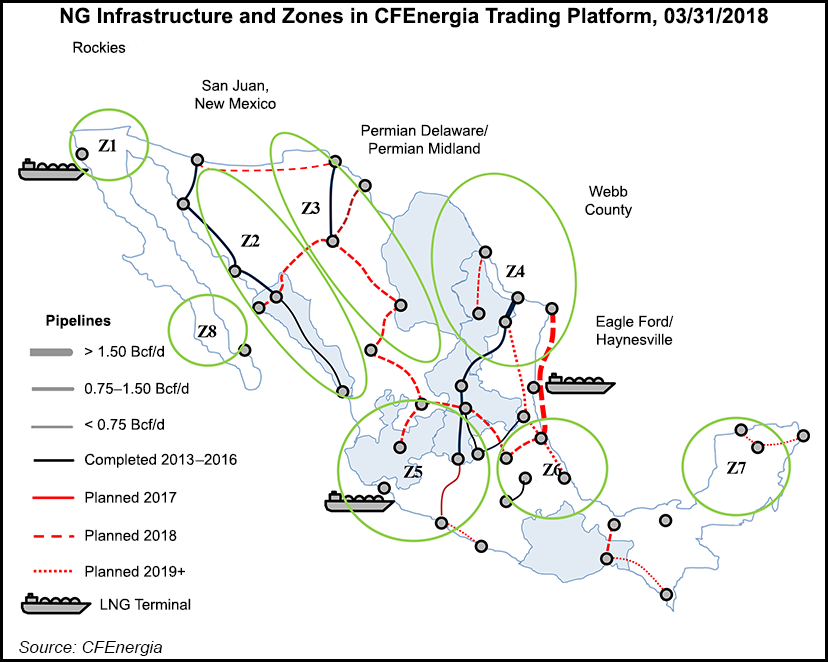

Turrent said the platform would include eight zones for trading natural gas in Mexico. CFEnergia would act as “the market maker to begin with and eventually transition to an open-ended platform where companies can post bids/offers and CFEnergia does all the scheduling with our transportation capacity.”

“I think the electronic trading platform will be a before-and-after moment for the Mexican gas market,” he added.

CFEnergia and CFEi were created to purchase fuel — also including coal and petroleum products — for CFE power plants and grow the utility’s fuel marketing business with third-party clients.

CFEnergia, which markets fuel within Mexico, has landed several new natural gas supply agreements over the last year, including deals with steelmaker ArcelorMittal, several private power producers and most recently for a fertilizer project in Sinaloa state.

Fuel sales to third parties generated 22.3 billion pesos ($1.18 billion) for CFE in 2017 or 4.8% of the company’s full-year consolidated revenues, versus 2.17 billion pesos in 2016, or 0.6% of total revenues that year.

The boost in fuel sales, along with increased electricity sales, helped drive up revenues by 32% in 2017 to 466 billion pesos ($24.7 billion), compared to 352 billion pesos in 2016. CFE posted a net loss of 9.9 billion pesos in 2017, compared to an 88.4 billion net loss in the prior year (excluding one-time savings on labor liabilities in 2016).

The 2018-2022plan also outlines the creation of a pipeline business unit that would start operating in the first half of this year. It “is mainly an administrative unit created inside the company to monitor how CFEnergia conducts its business of optimizing transportation capacity that the CFE holds,” Turrent said.

The new unit would continue the mandate of another administrative unit created last year to manage CFE’s pipeline contracts, according to the plan.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 | ISSN © 1532-1266 |